In our latest video series, The DBL Center marketing team turned the tables on Michael Cohen to interview the DBL Center President about recent initiatives and how The DBL Center has coped with the pandemic. Now more than ever, The DBL Center remains focused on providing our brokers with free tools they can use to

Since my father, David Cohen, first founded The DBL Center back in 1976, we have always focused on concierge-level service for our brokers. My father liked to frequent boutique hotels on vacation, and he wanted to model that personalized service as an insurance wholesaler in NY. That level of service wasn’t seen in the insurance

If you’re shopping around for a wholesale insurance broker for your statutory disability benefits and ancillary employee benefits — or if you’re already working with DBL Center — you may wonder what makes us different from other general agencies. Brokers gain a number of advantages working with The DBL Center for DBL and PFL

Use this tax season to reflect on how you can improve processes in your insurance agency It’s tax season once again and for insurance brokers, it’s also a good time to reflect on ways to improve business efficiency in your insurance agency. For small to mid-size businesses in New York and New Jersey, including many

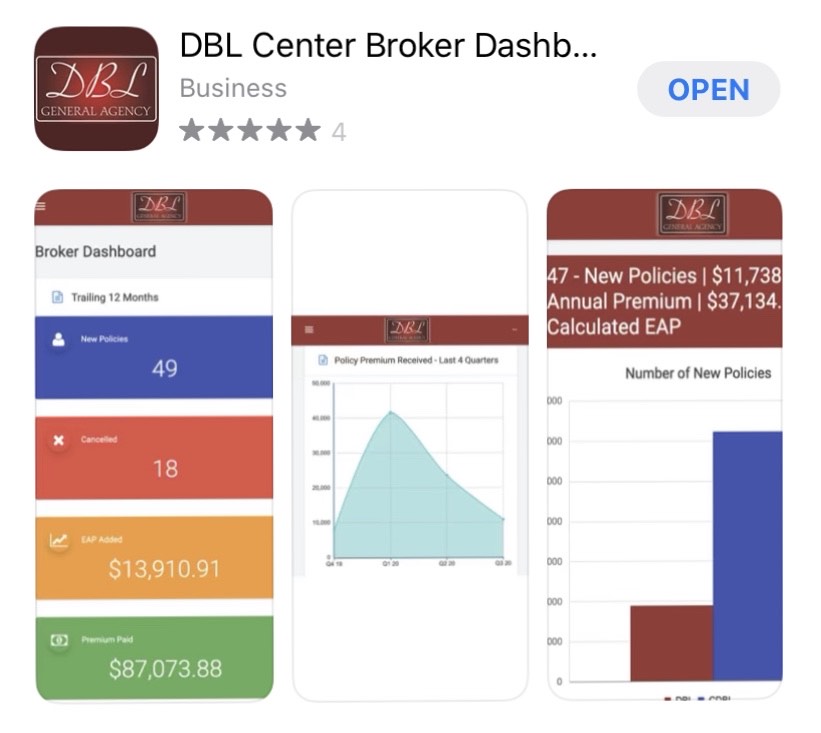

New application gives brokers deep analytics and actionable business insights to grow their business For 41 years, The DBL Center has provided brokers with white glove service and the lowest insurance premiums available for enriched DBL, ancillary benefits, group life, and more. As the industry changes, we stay ahead of the curve to deliver greater value.

- 1

- 2