Paid Family Leave (PFL) and Paid Family and Medical Leave (PFML) programs expand across the U.S. in 2023. A recent study from the CommonCentsMom.com found that the U.S. ranks the worst in the developed world for early childcare. The study analyzed the costs of early childcare in 40 countries relative to the mother’s income, how

How does PTO work in states with disability and family leave benefits? As a growing number of states roll out statutory Paid Family and Medical Leave programs and short-term disability insurance benefits, employers, HR managers, benefits advisors, and insurance brokers, alike, are trying to understand how PTO and PFML interact in terms of claims. In

Paid Family and Medical Leave went into full effect in January 2021 and benefits were fully rolled out by July 1, 2021. As of last summer, any eligible employees could file a claim to receive benefits. Maximum leave time varies depending on the reason for leave. Qualified employees could receive: Up to 20 weeks off

New York broke ground and made waves when it introduced the nation’s most generous Paid Family Leave legislation in 2016. By 2021, benefits had been fully phased in to provide up to 67% of an employee’s average weekly wage for up to 12 weeks. And, on January 1, 2023, PFL coverage will be expanded to

You’ve probably heard the expression, “Stay in your lane.” One of DBL Center founder David Cohen’s favorite quotes was “Stick to sewing.” Both expressions relate to finding what you’re good at, honing your skills and knowledge in that area, and not wasting time on diversions outside that field. Find the right people to support you

Smart New York disability insurance brokers have been thinking ahead to 2022 since the third quarter wrapped up. However, that’s not always easy to do as so much has changed in the past year. If you’ve been focused on the day-to-day, treading water and focused on maintaining your book of business without growing, that’s completely

The past year has brought shake-ups for statutory insurance brokers. Record-high rate hikes for temporary disability benefits (TDB) in New Jersey New Family Leave Insurance benefits for New Jersey Increased benefits for Paid Family Leave in New York The introduction of family and medical leave coverage in two more New England states Smart insurance brokers

New York insurance brokers may be getting questions from customers about the New York State Sick Leave (NYSSL) act, which went into effect September 30, 2020. However, employees cannot take paid sick leave through the state law until January 1, 2021, or at a time after that date if their employer requires them to

DBL Center brokers can make tax time easier for their customers Happy New Year! As we get back to the grind after the holiday season, NY DBL insurance brokers may have taxes on their mind – as do their customers. Tax forms, including W-2 forms and third-party Sick Pay statements, are due to employees by

Founded in 1972, ShelterPoint Life, formerly First Rehabilitation Life, has provided businesses in New York with statutory DBL and enriched DBL coverage for decades. ShelterPoint’s Director of Business Development Simon Klarides notes that the book is predominantly small group business of under 100 lives. The insurance carrier also provides ancillary benefits including dental, vision, and

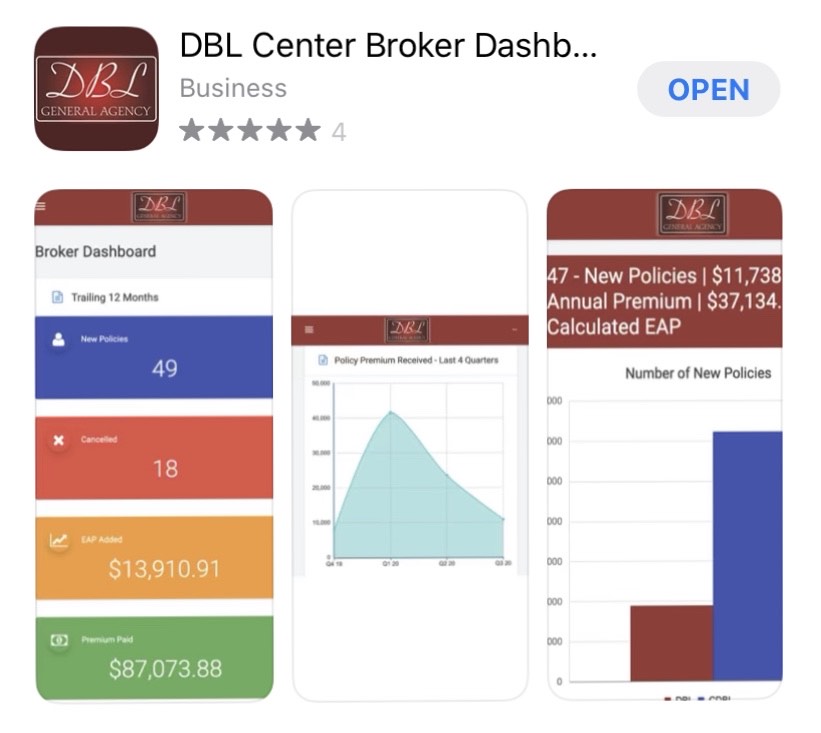

On the Mic with Mike: Selena Kutschera Talks About PFL, DBL and the Benefits of the Broker Dashboard

Working with the top insurance wholesaler in NY gives Selena a chance to make a difference for brokers Selena Kutschera, DBL Center’s Director of DBL and TDB never actually applied to work at DBL Center. She joined the family when DBL Center acquired competitor Combined DBL, a competitive insurance wholesaler in NY, in 2014.