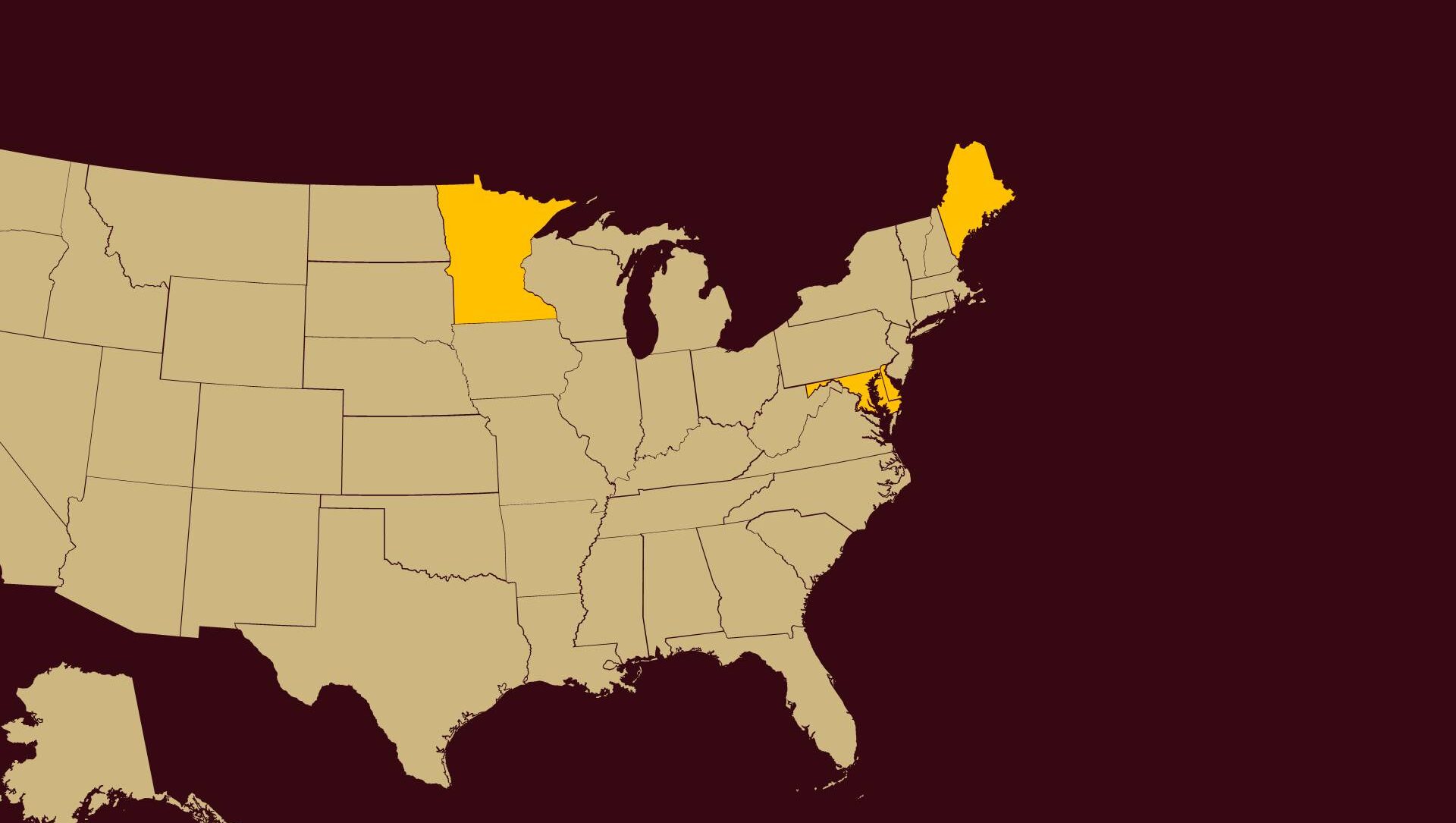

Family and Medical Leave: Four More States Launch PFML Everything brokers need to know about expanding revenue through required benefits The new year brings new Paid Family and Medical Leave legislation in four states. Insurance brokers should be aware that Delaware, Maryland, Maine, and Minnesota passed legislation requiring family and medical leave insurance for most

With more states introducing paid family leave, benefits administrators and human resource directors may have questions about the tax ramifications of paid leave. As a broker specializing in employee benefits, you probably have similar questions. While insurance brokers aren’t tax advisors, and shouldn’t act as such, knowing the answers to frequently asked questions can help

Each year, DBL Center insurance brokers eagerly await the new premium rates for the next year for New Jersey TDB and New York DBL insurance. A rate hike from the states means enhanced opportunities for brokers as business owners seek ways to save money on statutory benefits. This fall, we have even more to report.

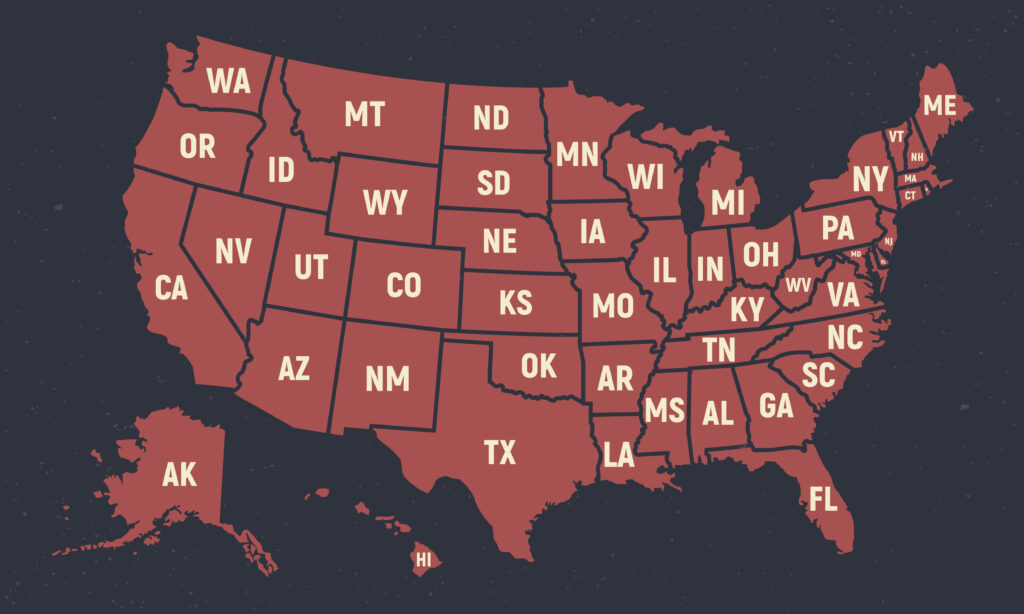

Paid Family Leave (PFL) and Paid Family and Medical Leave (PFML) programs expand across the U.S. in 2023. A recent study from the CommonCentsMom.com found that the U.S. ranks the worst in the developed world for early childcare. The study analyzed the costs of early childcare in 40 countries relative to the mother’s income, how

How does PTO work in states with disability and family leave benefits? As a growing number of states roll out statutory Paid Family and Medical Leave programs and short-term disability insurance benefits, employers, HR managers, benefits advisors, and insurance brokers, alike, are trying to understand how PTO and PFML interact in terms of claims. In

The trend of bleisure, blending business and leisure while you’re away, is on the rise. One recent statistic found that 60% of all long-distance business trips in the U.S. turn into bleisure trips. When we’re not setting trends in the insurance industry here at DBL Center, we’re always willing to hop on trends that mean

As we enter a new working world post-pandemic, with many employers permitting flexible working hours or work-at-home arrangements, it’s required some adjustments. A new McKinsey American Opportunity Survey revealed that 58% of Americans report having the opportunity to work from home at least one day a week, with 35% working from home five days a

New York broke ground and made waves when it introduced the nation’s most generous Paid Family Leave legislation in 2016. By 2021, benefits had been fully phased in to provide up to 67% of an employee’s average weekly wage for up to 12 weeks. And, on January 1, 2023, PFL coverage will be expanded to

Just like New York, New Jersey, Massachusetts, and Connecticut, Hawaii also offers temporary disability insurance to employees for non-work related injury or illness. There is no maternity leave or paid leave component to Hawaii TDI, but the plan provides coverage for a pregnancy-related disability as well as other non-work related illnesses or injuries. As with

The past year has brought shake-ups for statutory insurance brokers. Record-high rate hikes for temporary disability benefits (TDB) in New Jersey New Family Leave Insurance benefits for New Jersey Increased benefits for Paid Family Leave in New York The introduction of family and medical leave coverage in two more New England states Smart insurance brokers

The recent Massachusetts Family and Medical Leave Act legislation has caused some confusion regarding who is eligible for FMLA, since the definition of “Family” according to the Massachusetts Commonwealth extends beyond what many people think of as immediate family. As Massachusetts insurance brokers grapple with new legislation surrounding the Massachusetts Family and Medical Leave Act

New York insurance brokers may be getting questions from customers about the New York State Sick Leave (NYSSL) act, which went into effect September 30, 2020. However, employees cannot take paid sick leave through the state law until January 1, 2021, or at a time after that date if their employer requires them to