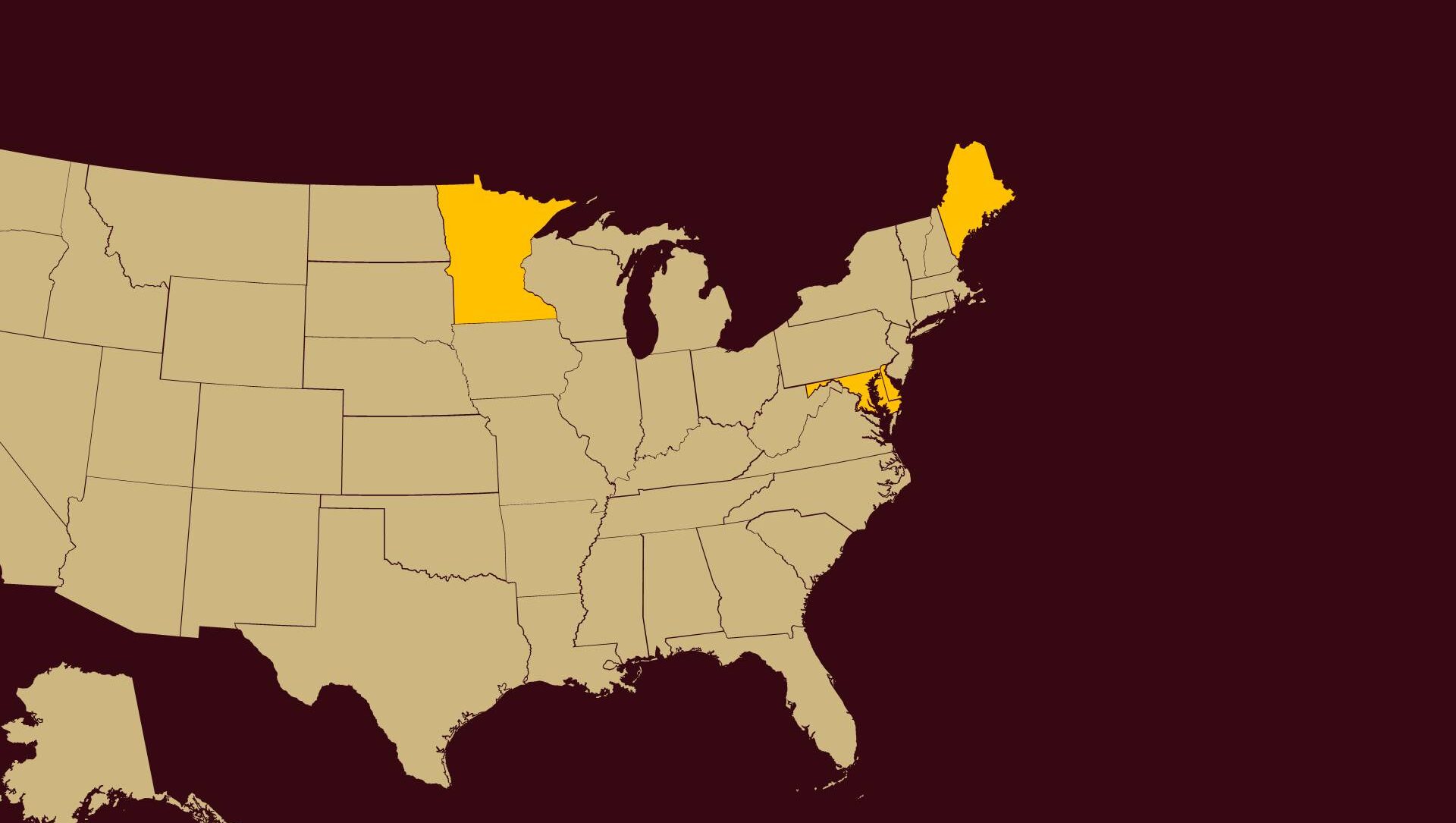

Family and Medical Leave: Four More States Launch PFML Everything brokers need to know about expanding revenue through required benefits The new year brings new Paid Family and Medical Leave legislation in four states. Insurance brokers should be aware that Delaware, Maryland, Maine, and Minnesota passed legislation requiring family and medical leave insurance for most

As people plan for the holiday season, travel, and shopping the sales, insurance brokers who manage NY Disability Benefits Law policies for clients are also planning for an important event. Fourth quarter premium payments are due for NY Disability Benefits Law for New York businesses. Annual bills will also be due by January 1, 2024,

The rapidly growing team at The DBL Center adds another name to our list of insurance experts ready to help our brokers with required benefits in specific states along with ancillary and group benefits across the U.S. The DBL Center recently appointed John Byrne Jr., formerly with Principal Financial Group, as Group Benefits Sales Representative.

Insurance brokers and employers should begin preparing now for Maryland PFML. Add Maryland to the growing list of states offering paid family and medical leave to many workers. As the federal government continues to discuss a U.S.-wide mandated paid family leave program, more state legislatures are introducing their own programs. On April 9, 2022, the

Beginning January 1, 2024, Colorado workers gain access to paid family leave to take care of their own medical conditions or a loved one. As major tech companies, including Twitter, Airbnb, DoorDash, and Reddit, advocate for federal paid family leave programs, more states are enacting legislation of their own. Colorado recently joined New York, New

When the state of Connecticut introduced its Paid Family and Medical Leave act, it opened the door for business owners of any size to privatize their PFML coverage for cost savings. Connecticut business owners can save even more money by bundling Connecticut PFML benefits with ancillary benefits, including dental, vision, and Group Life / AD&D

In the past several years, Paid Family Medical Leave legislation has been sweeping across the Northeast. The DBL Center has been at the forefront of guiding brokers to make the most of this new revenue stream, which can be bundled with ancillary benefits to provide business owners with cost savings while brokers enjoy increased commissions.

Find industry-leading videos, product demos, and insights The DBL Center, a wholesale insurance general agency specializing in statutory benefits, has launched a new section of its website to keep insurance brokers up to date on the latest statutory and ancillary employee benefit insurance industry news. Found in the drop-down menu of the About section on

Privatizing coverage through the Massachusetts State Family Medical Leave Act puts money in the pockets of Massachusetts business owners Business owners who want to privatize paid family medical leave in Massachusetts have until October 1, 2020, to make their decision. The DBL Center has more than 40 years experience in the statutory benefits markets in

Prior to the MA Paid Family Medical Leave Act, short-term disability benefits provided partial income replacement for non-work-related illnesses or injuries in Massachusetts. With MA PFMLA benefits going into effect on January 1, 2021, (and additional benefits beginning July 1, 2021), Massachusetts business owners may wonder if they still need to offer group STD to

The DBL Center, a wholesale insurance general agency specializing in statutory benefits, recently posted a summary of statutory disability and paid family and medical leave plans across the United States. Visit InsuranceWholesaler.net to find out what states are on the list. “Most people don’t realize this, but 37 states threw their hats in the ring

Get a free demo of the Broker Dashboard: Net Revenue Tracker today The DBL Center, a wholesale general agency, has been breaking new ground when it comes to providing superior customer service and a tech-forward approach to statutory disability sales for insurance brokers. The Broker Dashboard: Net Revenue Tracker software-as-a-service enables brokers to: Full Support

- 1

- 2