New York broke ground and made waves when it introduced the nation’s most generous Paid Family Leave legislation in 2016. By 2021, benefits had been fully phased in to provide up to 67% of an employee’s average weekly wage for up to 12 weeks. And, on January 1, 2023, PFL coverage will be expanded to

The DBL Center President and CEO Michael Cohen recently appeared as a guest on Model FA, a podcast for fiduciary financial advisors, hosted by David DeCelle. Many insurance brokers who work with Michael know his background as a stand-up comedian. But you may not know that he was very close to becoming a writer on

The past year has brought shake-ups for statutory insurance brokers. Record-high rate hikes for temporary disability benefits (TDB) in New Jersey New Family Leave Insurance benefits for New Jersey Increased benefits for Paid Family Leave in New York The introduction of family and medical leave coverage in two more New England states Smart insurance brokers

We all know 2020 presented major challenges for insurance brokers. I discussed some of these challenges with Charles Callery, Regional VP for Lincoln Financial, and Michael Pelligrino, Lincoln Financial sales representative in the video, “Getting Creative in the Time of Covid-19.” So much has changed this year – but adapting is an important part of

New York insurance brokers may be getting questions from customers about the New York State Sick Leave (NYSSL) act, which went into effect September 30, 2020. However, employees cannot take paid sick leave through the state law until January 1, 2021, or at a time after that date if their employer requires them to

NYS PFL rate and benefit increase goes into effect January 1, 2021As per the original legislation for the NYS Paid Family and Medical Leave Act, New York has announced a rate change and benefit increase for NYS PFL to go into effect January 1, 2021. Beginning in 2021, employees can collect up to $971.61 through

Massachusetts and Connecticut follow New York in adopting paid family leave benefits Tri-state area insurance brokers, take note. Big changes are afoot again when it comes to employee benefits, paid leave, and family leave insurance. New York’s Paid Family Leave has been in full swing since January 2018 and is set to reach the maximum

What brokers, HR directors, and company executives need to know about PFL in 2019 The new year is almost upon us, and that means more changes for HR directors, business owners, and insurance brokers in New York, once again, as they get up to speed on PFL in 2019. Look for PFL contributions to increase

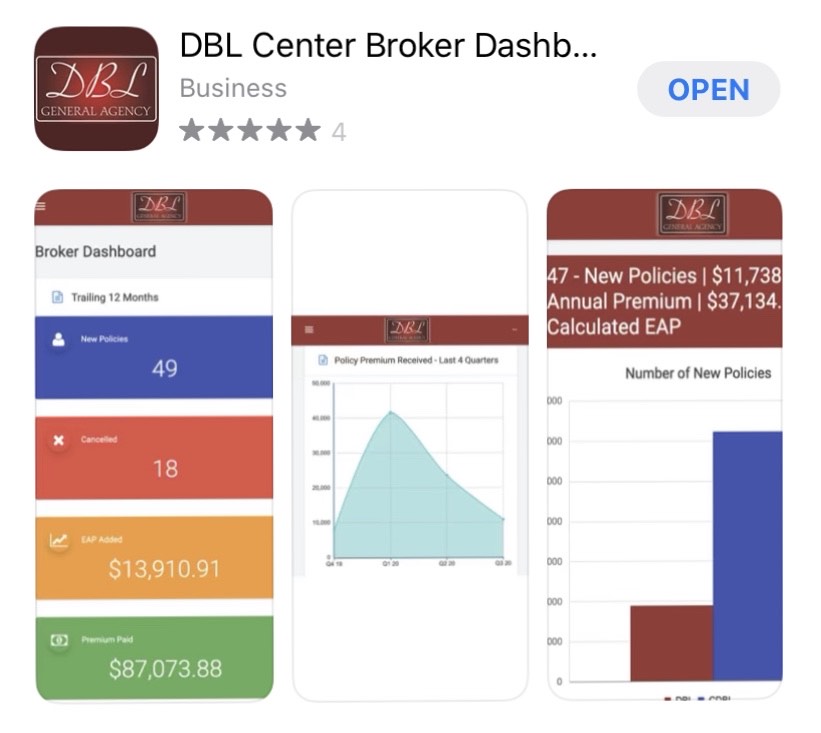

Bold statement from DBL Center President Michael Cohen leads into how brokers can grow their book of business with PFL P&C and health brokers know that enriched DBL in New York can be a tough sell. As a mandatory benefit, DBL is a no-brainer, but let’s face it: The commissions aren’t making anyone rich. That’s

The DBL Center and ShelterPoint Life help clear up confusion about Paid Family Leave in New York Are you ready for Paid Family Leave in New York? No doubt, employees are ready to enjoy more socially conscious, financially viable leave to care for newborn children, aging or sick loved ones, or adopted or foster children.