Dawn Allcot is a full-time freelance writer & owner of a content marketing agency. Her work has appeared on sites that include Forbes, Chase, Bankrate, & The Balance.

LTD offers “same occupation” coverage and no waiting periods for claims. Smart insurance brokers are always seeking ways to upsell ancillary benefits. If you have a stable of clients purchasing statutory benefits like TDB in New Jersey or Paid Family and Medical Leave (PFL, PFML) in a growing number of states, you have a prime

New Jersey TDB offers profit potential for brokers and advantages for business owners and claimants For years, New Jersey’s required Temporary Disability Benefit (TDB) was funded entirely by employers at a relatively low premium rate. Businesses could privatize TDB for better service, no waiting period on claims, and the option to receive benefits as a

Today’s insurance brokers face a complicated landscape of employee benefits. From learning the ins and outs of paid family and medical leave (PFML) in the states you serve, to the growing demand for benefits like Group Life /AD&D, and Worksite (Critical Illness, Hospital Indemnity & Accident), it’s a lot to manage. At The DBL Center,

Things are changing rapidly across the country in terms of employee benefits. More states have added paid family and medical leave benefits, with opportunities for brokers to earn commissions and save their clients’ money by privatizing PFML. New York State has passed pending legislation to increase the DBL premium and benefits rate, presumably by 2026.

As Mother’s Day and Father’s Day approach, we might be thinking about our loved ones and the ways we care for our own families. Many of us in the sandwich generation, late millennials and GenX, have already faced the loss of parents or may be caring for aging parents. Although these holidays are a joyful

Unlock the profit potential by helping your clients privatize paid leave programs in a growing number of states. Since New York first enacted Paid Family Leave in 2017, many additional states and the District of Columbia joined New York and California with leave options for new or adopting parents, spouses of deployed military personnel, and

The DBL Center’s Net Revenue Tracker Pro takes the guesswork out of RFPs and the busy work off your desk Insurance brokers today, like so many other professionals, are drowning in data. Between policy renewals, servicing your existing clients, and chasing leads, it’s easy to get bogged down in the minutiae of running an insurance

As the P&C insurance industry gets more competitive, with insurance brokers facing higher quotas to achieve bonuses and businesses watching every dollar, you might hope to find a pot of gold at the end of the rainbow this spring to help reduce your stress. The DBL Center can help you find it. Best of all,

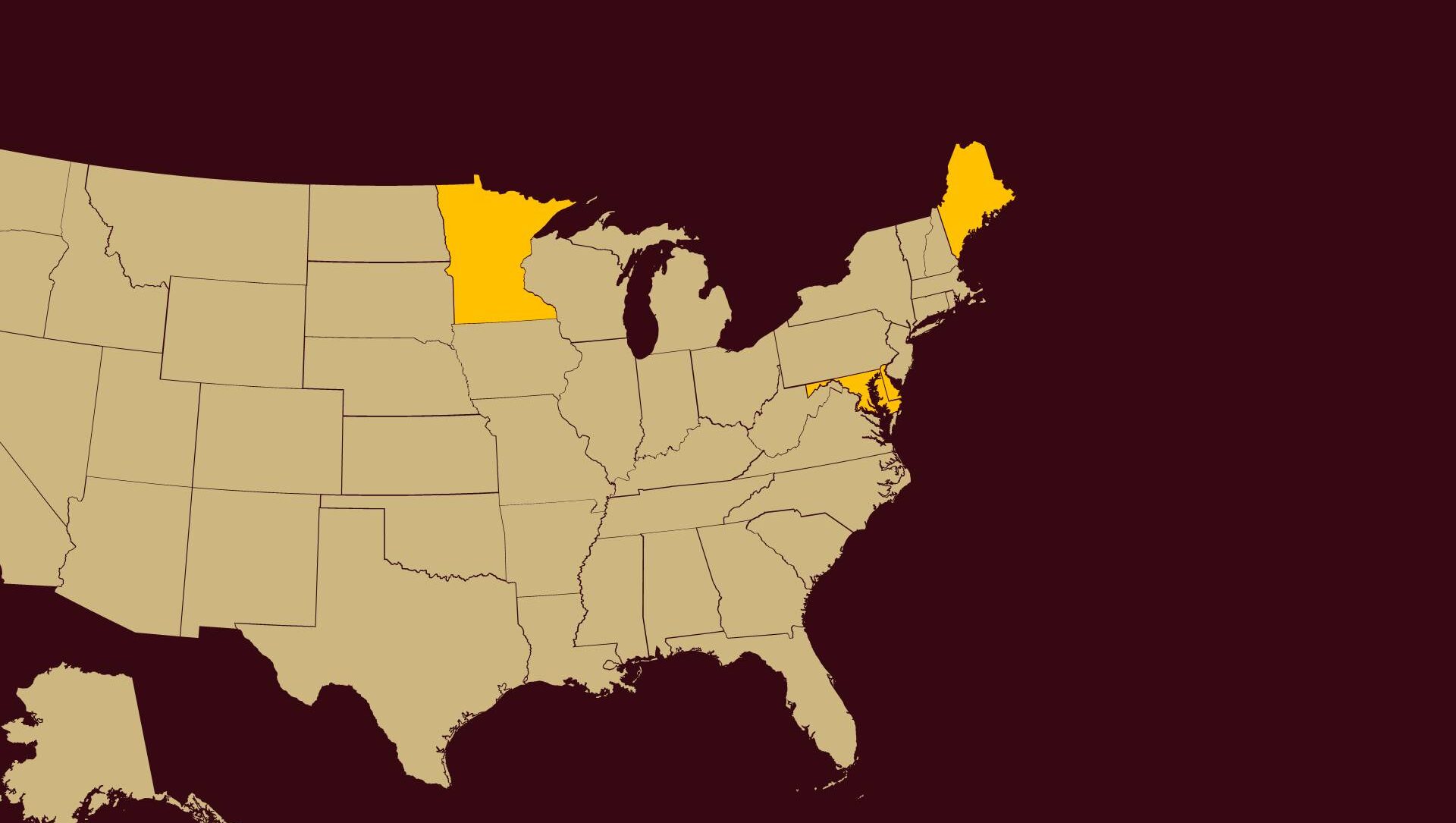

Family and Medical Leave: Four More States Launch PFML Everything brokers need to know about expanding revenue through required benefits The new year brings new Paid Family and Medical Leave legislation in four states. Insurance brokers should be aware that Delaware, Maryland, Maine, and Minnesota passed legislation requiring family and medical leave insurance for most

With more states introducing paid family leave, benefits administrators and human resource directors may have questions about the tax ramifications of paid leave. As a broker specializing in employee benefits, you probably have similar questions. While insurance brokers aren’t tax advisors, and shouldn’t act as such, knowing the answers to frequently asked questions can help

As an insurance broker, you already know how profitable it can be to upsell ancillary and voluntary worksite benefits to fill gaps in coverage. These affordable products can help workers cover expenses should they become unable to work because of an off-the-job injury or illness. Coverage may also extend to some family members. But when