The DBL Center’s Net Revenue Tracker Pro takes the guesswork out of RFPs and the busy work off your desk Insurance brokers today, like so many other professionals, are drowning in data. Between policy renewals, servicing your existing clients, and chasing leads, it’s easy to get bogged down in the minutiae of running an insurance

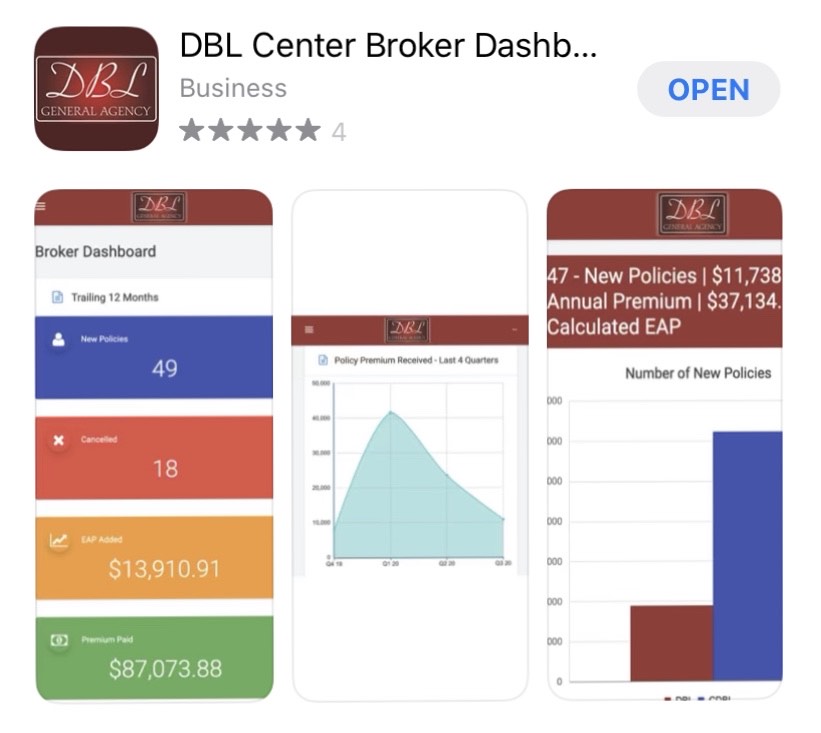

In 2021, the DBL Center launched a first-of-its-kind desktop and mobile app to help insurance brokers track their renewals, cancellations, and commissions. The Broker Dashboard: Net Revenue Tracker provided technology never utilized before in the P&C and statutory insurance industries. Brokers who take advantage of this free platform receive emails when their clients’ policies are

The DBL Center President and CEO Michael Cohen recently appeared as a guest on Model FA, a podcast for fiduciary financial advisors, hosted by David DeCelle. Many insurance brokers who work with Michael know his background as a stand-up comedian. But you may not know that he was very close to becoming a writer on

Increase revenue with our exclusive Broker Dashboard: Net Revenue Tracker As many companies went out of business in 2020 and others saw substantial revenue reductions, insurance brokers have struggled to collect payments for New York and New Jersey statutory disability insurance policies. The DBL Center is the first and only wholesale insurance broker to deliver

Here’s How to Help Your Customers Switch to a Private New Jersey TDB Plan I’ve discussed on several of my videos recently how fast time moves, and how crucial it is for us all to adapt to selling insurance in the time of Covid-19. Insurance brokers face more challenges than ever before when it comes

Most of us are happy to close the door on 2020, a year with multiple challenges from different fronts. While 2021 may not come in carrying a magic wand that will end the pandemic and the economic struggles of small business owners, it carries hope for a stronger future. Insurance brokers can follow these six

The past year has brought shake-ups for statutory insurance brokers. Record-high rate hikes for temporary disability benefits (TDB) in New Jersey New Family Leave Insurance benefits for New Jersey Increased benefits for Paid Family Leave in New York The introduction of family and medical leave coverage in two more New England states Smart insurance brokers

Insurance brokers across Massachusetts have an opportunity to increase their commissions and better serve Massachusetts business owners through the Massachusetts Paid Family Medical Leave Act. By helping your customers privatize Massachusetts PFML before October 1, you can offer premium discounts plus defer fourth quarter premium payments until January 1, 2020. Full Support to Help You

Insurance brokers know that DBL stands for “Disability Benefits Law,” which provides statutory New York State short term disability insurance to qualifying workers through employer-funded benefits packages. But here at DBL Center, we love a good play on words. We want to remind our brokers that this year, more than ever, the “DBL” in DBL

The DBL Center marketing team “Turned the Tables” on President and CEO Michael Cohen to put Michael in the hot seat for a three-part interview. In the first and third videos, he offered tips for insurance agents and talked about the value The DBL Center provides to its network of brokers. In this video, Michael

- 1

- 2