As insurance brokers, it’s your job to deliver the benefits your customers and their employees need, including packages that will help employers recruit and retain top workers. With remote work on the rise, employers have an endless talent pool to draw from as geographic location now matters less than it used to. And employee benefits

Do you remember Blockbuster’s end-of-late-fees? With the transition to DVD rentals, we no longer had to “be kind, rewind.” Late fees were the last inconvenience of the video store rental service. And then Blockbuster enticed us all to “Celebrate the end of late fees.” Full Support to Help You Earn More Maximizing your revenue potential

Just like New York, New Jersey, Massachusetts, and Connecticut, Hawaii also offers temporary disability insurance to employees for non-work related injury or illness. There is no maternity leave or paid leave component to Hawaii TDI, but the plan provides coverage for a pregnancy-related disability as well as other non-work related illnesses or injuries. As with

New York insurance brokers may be getting questions from customers about the New York State Sick Leave (NYSSL) act, which went into effect September 30, 2020. However, employees cannot take paid sick leave through the state law until January 1, 2021, or at a time after that date if their employer requires them to

Last year, the State of New Jersey announced a rate hike and benefits increase for NJ State temporary disability insurance to go into effect in 2020. The first increase took place on January 1, 2020, when the NJ state disability insurance benefit increased to 66.67% of a worker’s average weekly salary to a maximum of

In any industry, employees represent the company’s greatest resource. This is true in your insurance agency, and also for the customers you serve. The DBL Center has been heavily focused on short term disability insurance in NY State recently, as we continue into the third year of Paid Family Leave coverage while having to contend

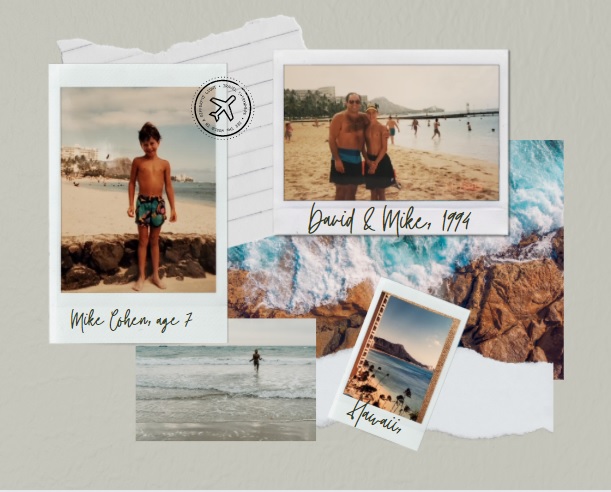

DBL Center’s Ancillary Benefits Account Manager Annette Sperandio Talks About Technology, Service, and the Surprising Poster in Michael Cohen’s Office Ancillary Benefits Account Manager Annette Sperandio joined the team three years ago, at the beginning of its most recent growth phase. Coming to DBL Center from the prestigious Chernoff Diamond firm, Annette was looking for

Financial stress affects every aspect of an employees’ life, including their work performance. When employees feel as if they aren’t prepared if illness or injury strikes, their health, and workplace productivity suffers. Employees spend an average of 13 hours per month worrying about money while they’re at work, according to a study by Mercer. In

Even as a P&C broker, you can help your customers relieve the pain of out-of-pocket medical costs The DBL Center is always on the lookout for creative tools to help you address your clients’ pain points when it comes to essential insurance coverage. While we specialize in DBL coverage and other temporary disability benefits, we

Coastal Insurance offers tips to expand your book of business with strategic cross-selling of home insurance, DBL coverage, and ancillary products By David Clausen, Coastal Insurance If you’re like most P&C brokers, NYS DBL and NJ TDB insurance aren’t your only niches. Most brokers sell a variety of lines, whether it’s healthcare, business insurance, or

Artificial intelligence (AI) has become prevalent in every industry and in many homes, as well. If you’ve asked Siri to help you book a reservation at your favorite restaurant through OpenTable or used Alexa to create a playlist for a cocktail party you’re hosting, you’ve used AI. In business settings, AI is beginning to help

Customer education goes a long way when it comes to selling employee benefits As an insurance agent, you understand the intricacies of the employee benefits you sell, including maternity leave benefits available through Paid Family Leave (PFL) in New York. You can show customers how to file a DBL or PFL claim, tell them when