Dawn Allcot is a full-time freelance writer & owner of a content marketing agency. Her work has appeared on sites that include Forbes, Chase, Bankrate, & The Balance.

The DBL Center marketing team “Turned the Tables” on President and CEO Michael Cohen to put Michael in the hot seat for a three-part interview. In the first and third videos, he offered tips for insurance agents and talked about the value The DBL Center provides to its network of brokers. In this video, Michael

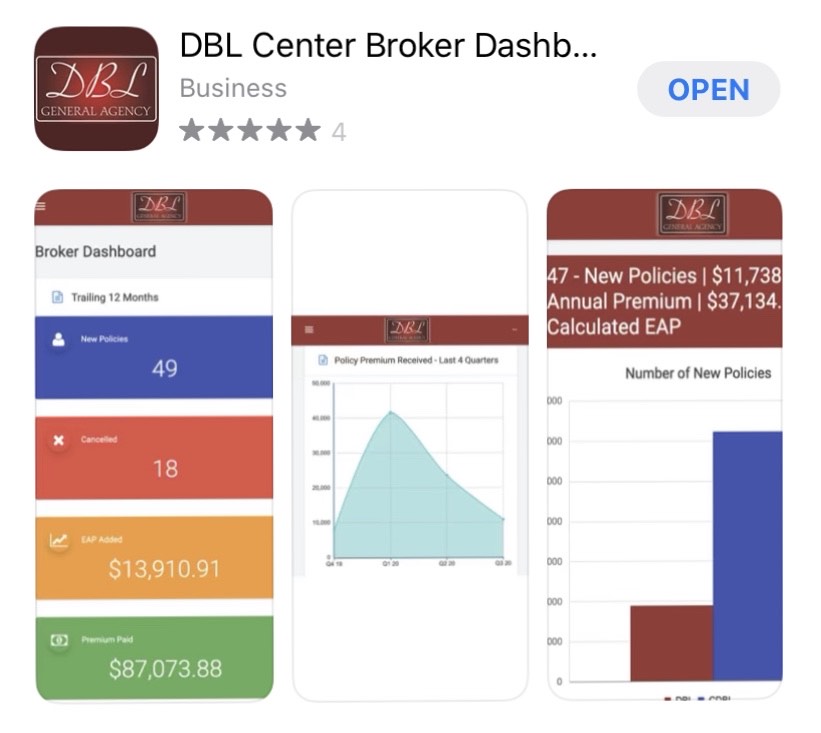

In our latest video series, The DBL Center marketing team turned the tables on Michael Cohen to interview the DBL Center President about recent initiatives and how The DBL Center has coped with the pandemic. Now more than ever, The DBL Center remains focused on providing our brokers with free tools they can use to

In any industry, employees represent the company’s greatest resource. This is true in your insurance agency, and also for the customers you serve. The DBL Center has been heavily focused on short term disability insurance in NY State recently, as we continue into the third year of Paid Family Leave coverage while having to contend

Last year, Massachusetts passed the Massachusetts Paid Family and Medical Leave Act (PFML). The law entitles all Massachusetts employees and some independent contractors paid family leave of up to 12 weeks to care for a family member and paid medical leave of up to 20 weeks for a non-work-related injury or illness. (Read more about

The insurance business, especially for those involved in selling statutory benefits like NY State disability insurance (NYS DBL coverage), has always been based on relationships. The relationships between brokers and their customers, carriers and general agencies, and the wholesale insurance agency and its brokers, all make it easier to create the best benefits packages with

With news of the Massachusetts Family Leave Act and PFML benefits now mandated in Massachusetts, The DBL Center is seeking ways to scale our high-touch business model and give Massachusetts brokers selling PFML even better access to our personalized service, knowledge, insight, and relationships. Kelvin Joseph, Founder and CEO of Kool Kel Marketing, has helped

Things are changing rapidly across the country with new legislation related to PFL for coronavirus. Besides maintaining our position as one of the top insurance wholesalers in New York (and beyond), we are striving to be your COVID-19 insurance resource center in New York and across the northeast U.S. Even before COVID-19 hit the U.S.,

Massachusetts becomes the fourth state in the Northeast to mandate benefits under a paid family and medical leave act DBL Center is ready to offer Massachusetts insurance brokers incredible savings on PFML plans under the new Massachusetts Paid Family and Medical Leave Act. Full Support to Help You Earn More Maximizing your revenue potential with

With the introduction of Paid Family Medical Leave in Massachusetts, along with mergers, acquisitions, and the launch of robust software to help brokers manage it all, 2019 was an exciting year in statutory employee benefits and group ancillary products. At the close of 2019, DBL Center President and CEO Michael Cohen sat down the John

DBL Center brokers can make tax time easier for their customers Happy New Year! As we get back to the grind after the holiday season, NY DBL insurance brokers may have taxes on their mind – as do their customers. Tax forms, including W-2 forms and third-party Sick Pay statements, are due to employees by