Is enriched New York disability insurance the way to keep high-level workers in tech, finance, and other competitive fields?

There’s a mass exodus of white-collar workers from a variety of fields, including finance and technology. What experts are calling the “Great Resignation” continues in spite of six figure salaries for investment bankers fresh out of college and employer accommodations such as flex-time and remote work for professionals in a variety of other industries.

Survey Finds Skilled Employees Leaving the Workforce En Masse

A new survey from HiBob, an HR/people management platform and Fiverr, an online freelancer marketplace, has revealed that it’s not just hourly wage workers who are jumping ship, either. Forty-six percent of HR professionals surveyed said that managers and directors are leaving, rather than entry-level workers.

“This leaves companies with a massive skills gap… They need to fill manager and director roles, ones that require years of experience and knowledge,” said Shany Malbin, general manager of Fiverr Business, in a GoBankingRates article.

The study went on to reveal that it takes, on average, as much as six months to hire new full-time employees. Coupled with the costs associated with recruiting and training new hires, it is in any business owners best interests to retain their in-house talent as long as possible.

But how can New York disability insurance and voluntary employee benefits make a difference?

Skilled Talent Turns to Freelance Gigs

The report revealed that 54% of HR professionals said many workers that resigned started their own business or decided to freelance. Workers are seeking flexibility, the ability to set their own hours, and work from anywhere. The DBL Center, which has excellent retention rates for our key employees, has offered as much flexibility as possible to our workers since 2004. “All I have done over the years is reinvested in technology to keep things current and safe from a security perspective, enabling my team to have continued flexibility,” said DBL Center President and CEO Michael Cohen.

Offering flexible hours, remote work, and perks like on-site childcare may help keep top employees. Statutory PFL in New York can also entice workers who are caregivers by giving them flexible, paid time off to care for children or their aging parents.

For many workers, statutory benefits like New York disability insurance, along with voluntary employee benefits and enriched DBL packages, could be another draw that keeps them employed. After all, freelancers in New York aren’t required to provide their own New York disability insurance and ancillary benefits are rarely available – or affordable – for self-employed individuals.

Why New York Disability Insurance Matters to Upper-Level Employees

Enriched DBL coverage tends to benefit executive-level employees and management as much, if not more, than it benefits other workers in an organization. Enriched DBL coverage enhances New York disability insurance to a cap of $850 per week. That’s not likely to cover all the monthly expenses of a six-figure, salaried employee – especially in New York. But coupled with accident insurance or critical illness insurance, it can help an ill or injured employee avoid tapping into their investments or rainy-day savings fund, offering peace-of-mind for the employee and their family.

“It takes 7.2 years to double income from investments at a rate of 10%,” explains DBL Center President and CEO Michael Cohen. “When employees have savings, it’s wise to keep it parked where it can grow.”

Similarly, ancillary benefits like vision, dental, and Group Life / AD&D offer tremendous value to employees who are likely to invest in regular vision and dental care, including braces for their kids.

How You Can Profit from the Great Resignation and Employee Retention Struggles

Insurance brokers are in a unique position to solve workforce retention challenges in a variety of industries, including finance and technology.

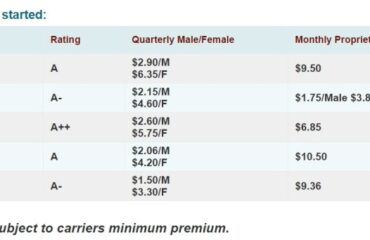

Spotlight New York disability insurance and voluntary employee benefits as a way to keep talented employees from taking the entrepreneurial route. Point out the cost savings employers will experience when they bundle statutory benefits like PFL and DBL with enriched DBL and ancillary benefits.

For business owners, enriching their employee benefits package will cost less than recruiting, hiring and training new talent. Productivity won’t suffer and they can focus on growing their business, knowing that their insurance broker is working in their best interests as a crucial part of theirteam