We all know 2020 presented major challenges for insurance brokers. I discussed some of these challenges with Charles Callery, Regional VP for Lincoln Financial, and Michael Pelligrino, Lincoln Financial sales representative in the video, “Getting Creative in the Time of Covid-19.” So much has changed this year – but adapting is an important part of

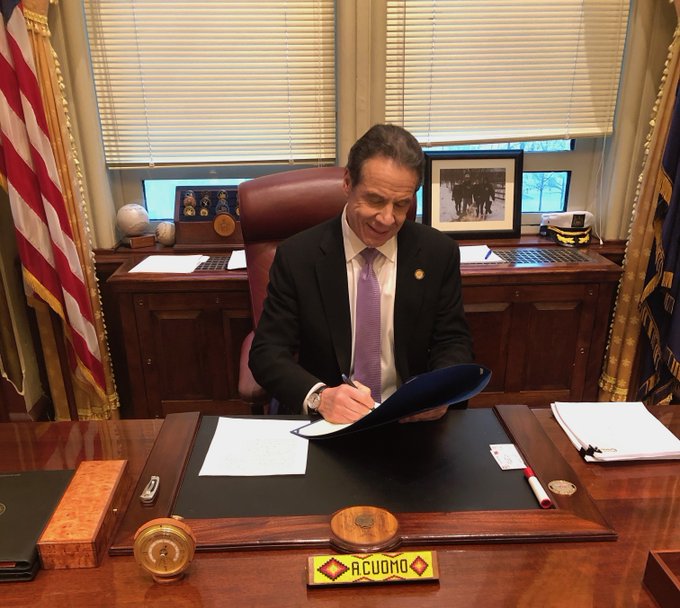

We’re living in unprecedented times and federal, state, and local governments are looking for ways to adapt. Seeking a balance between regulations and budget, legislation has sought to help Americans keep their businesses open and their employees paid through the vast challenges 2020 has brought us. Most business owners in New York, along with insurance

In an attempt to keep the economy moving and provide Americans with the financial relief they need during the COVID-19 pandemic, the Federal government has introduced the “Families First Coronavirus Response Act.” Beginning April 2, this act provides emergency paid sick leave benefits to employees unable to work for a variety of reasons. Employees may