Dawn Allcot is a full-time freelance writer & owner of a content marketing agency. Her work has appeared on sites that include Forbes, Chase, Bankrate, & The Balance.

From the duration to the benefit payouts, DBL and PFL differ significantly. Brokers in New York can now sell a new mandatory benefit: Paid Family Leave. We’ve been talking about this new coverage since New York State announced the law in April. As January approaches, the benefit becomes reality in two short months. As news

Protect yourself from the uncertainty caused by PFL benefits and earn more commissions with enriched DBL coverage. In our last post, we talked about the challenges inherent in PFL riders. It may not be the cash cow brokers had expected when it was first announced. The amount of commission you’ll earn will depend upon the

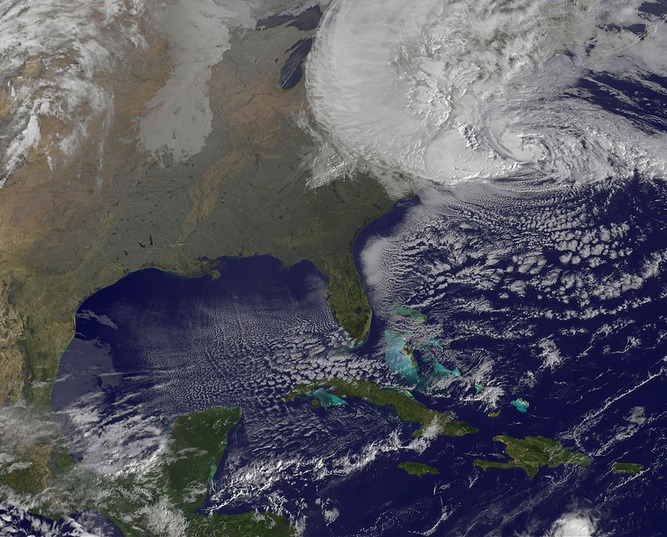

History (nearly) repeats itself with the introduction of Paid Family Leave October 29, 2012: It was a sad day for many New Yorkers as properties were swept away in Superstorm Sandy, businesses went under, and more than 8.1 million homes across the U.S. were left without electricity for a week or more. Superstorm Sandy caused

Autumn is approaching and, here at The DBL Center, it’s one of our favorite times of the year. Autumn on Long Island is absolutely beautiful, with so much to do. Baseball season comes to a climactic ending with the pennant race heating up and the promise of post-season play. (We don’t want to talk about

Bold statement from DBL Center President Michael Cohen leads into how brokers can grow their book of business with PFL P&C and health brokers know that enriched DBL in New York can be a tough sell. As a mandatory benefit, DBL is a no-brainer, but let’s face it: The commissions aren’t making anyone rich. That’s

DBL Center app with mobile and desktop dashboards gives brokers more choices and easier account management Earlier this year, The DBL Center announced the upcoming launch of a mobile app and dedicated website that provides our brokers access to a DBL Center app dashboard to manage all your accounts easily online, from anywhere with Internet

Take advantage of numerous member benefits, from networking opps to discounts on important services through New York Business Council If you’ve been in the insurance brokerage business for any length of time, you understand how important networking is. Whether you use inbound marketing and SEO to sell insurance products online or rely on real-world networking

One of The DBL Center’s preferred carrier partners, AmTrust, offers the information you need to help your clients get ready for PFL and ensure compliance. “At the early stage of any new insurance regulation, education is key.” This is how Joy Maas, Director of Marketing, Sales, and Accountant Management for AmTrust Financial Services, a top

The DBL Center and ShelterPoint Life help clear up confusion about Paid Family Leave in New York Are you ready for Paid Family Leave in New York? No doubt, employees are ready to enjoy more socially conscious, financially viable leave to care for newborn children, aging or sick loved ones, or adopted or foster children.

The opportunities under Paid Family Leave are too powerful to ignore. Are you an insurance broker worried about managing the added operational and transactional requirements of New York’s new Paid Family Leave laws? Although the rate has yet to be announced (as of this writing), and no one knows the commission potential, one top DBL

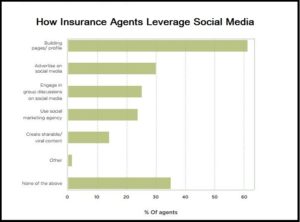

Your insurance agency is sure to get noticed if you use these tactics to reach prospective clients. The world of insurance is changing rapidly, but word-of-mouth referrals remain the biggest source of leads for property and casualty brokers. Word-of-mouth, today, means a lot more than attending local networking meetings or playing golf with business owners