History (nearly) repeats itself with the introduction of Paid Family Leave

October 29, 2012: It was a sad day for many New Yorkers as properties were swept away in Superstorm Sandy, businesses went under, and more than 8.1 million homes across the U.S. were left without electricity for a week or more.

Superstorm Sandy caused losses totaling $19 billion dollars, resulting in delayed payouts and financial hardship to the insurance agencies that paid out more than they’d earned in premiums. Many P&C brokers struggled to survive.

Meanwhile, Zurich Insurance Company, a leading global business insurance carrier, had just left the New York State DBL market a week prior due to a number of factors. Turmoil and uncertainty plagued the industry, as New York tri-state area business owners struggled to pick up the pieces and adopt a “new normal” after Sandy.

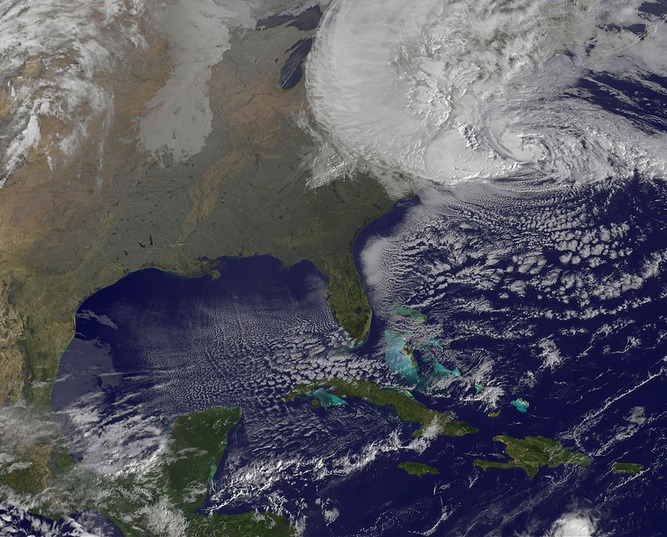

Here we are almost exactly five years later, and the entire U.S. is banding together to assist those suffering from the aftereffects of Hurricanes Harvey and Irma in Texas and Florida.

In New York, as we write this, the wind whips outside the windows of our Long Island headquarters, and the nearby Costco parking lot is packed as Long Islanders brace for a tropical storm —which could be the first of many this ominous hurricane season.

In the disability insurance sector, changes are once again brewing that have nothing to do with Mother Nature’s wrath. Paid Family Leave, a necessary insurance coverage that will provide employees with a living wage as they take time off to bond with a newborn or newly adopted child, care for an elderly parent, or hold down the fort while their spouse serves in the military, may burden some disability insurance carriers past their breaking point.

We don’t want to be alarmist. We only want to report the news with our analysis as we see it.

The Problems with PFL that No One Else Is Talking About

There are only a few select carriers that have committed to write PFL, which is offered as a mandatory rider to DBL coverage in New York State beginning January 1, 2018. Fortunately, those carriers are doing an excellent job of educating small business owners and HR directors about the implications of the coverage, as well as giving brokers what they need to know about the policies. DBL Center brokers have the added advantage of our industry experience and knowledge, along with access to educational webinars and live informational sessions. We’ve worked hard to make the transition to mandatory PFL coverage easy for brokers and small business owners alike.

But some challenges remain. Because PFL coverage is mandatory and written with DBL coverage, brokers will be left with fewer choices for DBL. Some carriers have already left the market, just as Zurich did five years ago. We expect many more to exit in the beginning of 2019, after the numbers come in for the first year of PFL coverage.

PFL, as it stands, is not profitable for insurance carriers. Payouts could easily total more than premiums, leaving carriers in the same position P&C brokers faced immediately following Superstorm Sandy. Some carriers will write PFL riders—because the only other choice is to leave the game altogether. But they may not offer commissions on the riders. Some carriers are recommending that brokers write enriched DBL on their existing policies to earn the commissions they expected from PFL.

Enriched DBL: The Answer to Bigger Commissions

There are a number of reasons to enrich DBL coverage right now. Not only is enriched DBL one of the more profitable products for brokers to write, it also provides customers with the best coverage for their money.

As an example, small business owners can enrich DBL coverage in $50 increments for just 44 cents every $50, up to $850 total. For an investment of just $5 a year, employees can get $50 more per week for up to 26 weeks. It doesn’t make sense not to enrich DBL. Paid Family Leave was carefully designed to provide employees with a living wage while they are out on leave. Mandatory DBL coverage only pays a maximum of $170 per week. Who can live on that in New York?

Most states that offer Paid Family Leave offer comparable benefits for disability claims. This helps reduce fraudulent claims and helps maintain employee morale by leveling the playing field and offering all employees comparable benefits if they need them.

DBL Center Brokers: Weathering the Storm

With Harvey and Irma on our minds, New Yorkers last week prepared for a storm that never came. Just like Mother Nature, the insurance industry is fickle. And, in both cases, it’s important to be prepared.

Carriers can exit at any time, for any reason, just as Zurich did in 2012. Who will be next? Brokers who align with DBL Center preferred carriers who are writing PFL riders are protecting themselves against changes in the marketplace.

Educate your customers about PFL riders before someone else does. Be their authoritative source and guide them to the right decisions, including enriching DBL so it is in line with PFL benefits.

Fortunately for brokers working with The DBL Center as their insurance wholesaler, we make it easy to write enriched DBL policies and earn greater commissions. Stay tuned, because next week we talk with our Director of DBL and TDB Benefits, Selena Kutschera, to show you just how simple it is to increase commissions with enriched DBL in three easy steps.

Meanwhile, stay safe and dry. The best protection against any storm is the right preparation. Our thoughts are with those across the country affected by this season’s hurricanes and storms.