As we return to our offices following Labor Day weekend, the unofficial end of summer, the New York and New Jersey state insurance departments have made some important announcements for business owners and insurance brokers in the two states. Read on to find out the new premium rates and coverage levels for Statutory Disability and

Massachusetts and Connecticut follow New York in adopting paid family leave benefits Tri-state area insurance brokers, take note. Big changes are afoot again when it comes to employee benefits, paid leave, and family leave insurance. New York’s Paid Family Leave has been in full swing since January 2018 and is set to reach the maximum

Top New York insurance wholesaler announces the acquisition of DBL Advantage Etc. Ltd Effectively immediately on January 1, 2019, the DBL Center Ltd. has acquired DBL Advantage Etc. Ltd., a New York-based licensed General Agency specializing in NYS DBL, Paid Family Leave, NJ TDB and group ancillary benefits. The synergy between the two company’s insurance

What brokers, HR directors, and company executives need to know about PFL in 2019 The new year is almost upon us, and that means more changes for HR directors, business owners, and insurance brokers in New York, once again, as they get up to speed on PFL in 2019. Look for PFL contributions to increase

Customer education goes a long way when it comes to selling employee benefits As an insurance agent, you understand the intricacies of the employee benefits you sell, including maternity leave benefits available through Paid Family Leave (PFL) in New York. You can show customers how to file a DBL or PFL claim, tell them when

A focus on customer education and diverse offerings set Hometown Insurance Agency of Long Island apart Hometown Insurance Agency, based in Bohemia, New York, has been serving Long Island, upstate New York, and parts of the New York tri-state area since 1979. Hometown provides a full line of insurance products, with a 50/50 split of

DBL Center helps Coastal Insurance navigate the rocky waters of New York Paid Family Leave The story begins 14 years ago, as many Long Island stories do, in a diner. Through a referral from another local business owner, David Clausen of Coastal Insurance, an independent insurance agency in NY, met with Michael Cohen of DBL

New Paid Family Leave Resource Center presents PFL claim forms and more Full Support to Help You Earn More Maximizing your revenue potential with Net Revenue Tracker Dashboard. We are well into 2018 and, as a New York insurance broker, you’ve got the basics of Paid Family Leave down. It’s the new comprehensive,

Family leave benefits in New York bring new IRS tax implications Disability Benefits Law (DBL) brokers in New York State are getting a handle on the new paid family leave benefits, with the new PFL law set to start January 1, 2018. The DBL Center has provided a host of paid family leave resources and

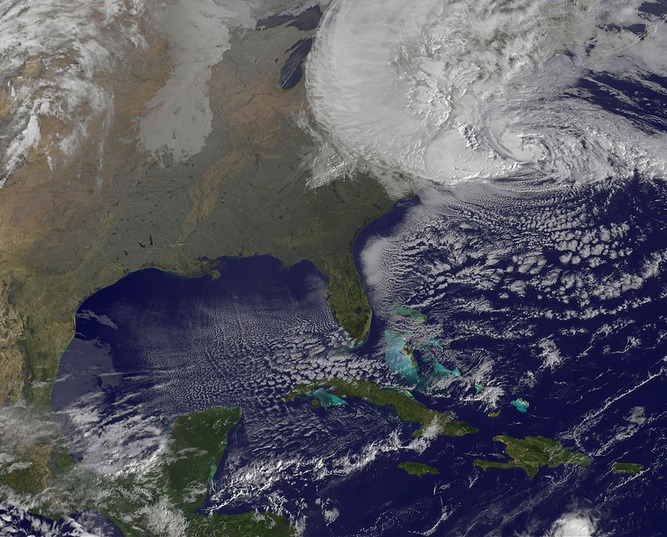

History (nearly) repeats itself with the introduction of Paid Family Leave October 29, 2012: It was a sad day for many New Yorkers as properties were swept away in Superstorm Sandy, businesses went under, and more than 8.1 million homes across the U.S. were left without electricity for a week or more. Superstorm Sandy caused

Autumn is approaching and, here at The DBL Center, it’s one of our favorite times of the year. Autumn on Long Island is absolutely beautiful, with so much to do. Baseball season comes to a climactic ending with the pennant race heating up and the promise of post-season play. (We don’t want to talk about

Bold statement from DBL Center President Michael Cohen leads into how brokers can grow their book of business with PFL P&C and health brokers know that enriched DBL in New York can be a tough sell. As a mandatory benefit, DBL is a no-brainer, but let’s face it: The commissions aren’t making anyone rich. That’s