Increase your productivity and close more sales before the disability benefits deadline. Are you looking at your business 120 days out? What you do now will reap rewards in the next quarter. As the April 1 deadline approaches to write NYS disability benefits, as well as New Jersey TDB, Paid Family Leave in Connecticut, and

Post updated on November 15, 2020 Covid-19 has brought many challenges to business owners, HR directors, and employees across the Northeast. It has also created many questions regarding temporary disability benefits and eligibility. As a trusted insurance broker, it helps to have answers to frequently asked questions regarding temporary disability and long term disability payments.

Insurance brokers should be able to rely on their wholesale general agency to lead the digital revolution within the insurance industry. A recent article in The Digital Insurer pointed to chatbots—sophisticated artificial intelligence programs that can answer questions and provide customer service for companies in much the way human representatives can—as replacing insurance underwriters in

Are you ready with enriched disability coverage for your employees or customers? If you’re running a business or have a full-time career, are raising a family, and managing to juggle the other responsibilities of adulthood, you already know the holidays are stressful. But did you know the months following the holidays are more dangerous than

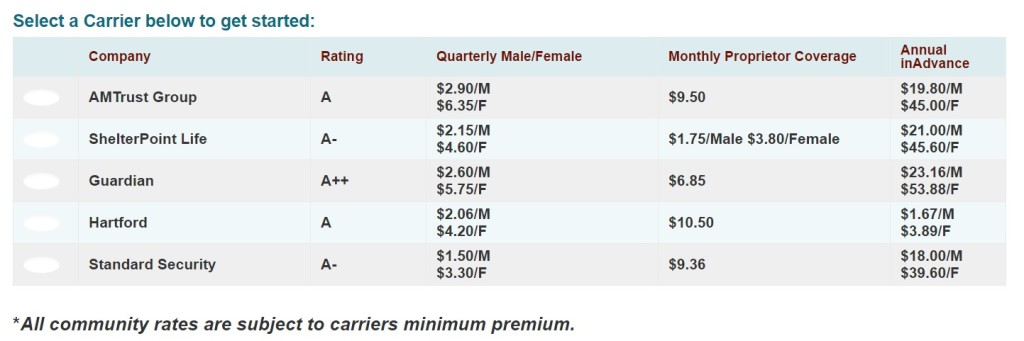

Are you a property & casualty broker whose products include worker’s compensation insurance, mandatory disability benefits, and ancillary benefits such as dental, vision, or life insurance? Have you considered the benefits of working with an insurance wholesaler? Do you spend the time to shop each carrier for every client, in order to secure the lowest

Everything a small business owner needs to know about DBL and enriched DBL benefits. NYS DBL Coverage, or Disability Benefits Law, ensures that employees who are injured, ill, or give birth to a child can take time off without losing all their income. Although disability benefits only pays 50 percent of an employee’s paycheck—and only up

InsuranceWholesaler.net website makes it easy to bind NYS DBL coverage in New York for under 50 lives. Small business owners face the struggle of being the HR director, sales manager, CEO, CFO/controller, CIO—and any other C-level titles you may want to add. The DBL Center Ltd. is large enough to exceed the expectations of even the