Use this tax season to reflect on how you can improve processes in your insurance agency It’s tax season once again and for insurance brokers, it’s also a good time to reflect on ways to improve business efficiency in your insurance agency. For small to mid-size businesses in New York and New Jersey, including many

New Paid Family Leave Resource Center presents PFL claim forms and more Full Support to Help You Earn More Maximizing your revenue potential with Net Revenue Tracker Dashboard. We are well into 2018 and, as a New York insurance broker, you’ve got the basics of Paid Family Leave down. It’s the new comprehensive,

DBL Center app with mobile and desktop dashboards gives brokers more choices and easier account management Earlier this year, The DBL Center announced the upcoming launch of a mobile app and dedicated website that provides our brokers access to a DBL Center app dashboard to manage all your accounts easily online, from anywhere with Internet

One of The DBL Center’s preferred carrier partners, AmTrust, offers the information you need to help your clients get ready for PFL and ensure compliance. “At the early stage of any new insurance regulation, education is key.” This is how Joy Maas, Director of Marketing, Sales, and Accountant Management for AmTrust Financial Services, a top

Partnerships with Steiner Sports and The Friar’s Club make it possible for The DBL Center to provide exclusive access to luxury sports and celebrity events Being a P&C or Life & Health insurance broker in the Tri-State area isn’t easy. Constant regulatory changes in healthcare, taxation related to estate planning, and, most recently, new Paid

The opportunities under Paid Family Leave are too powerful to ignore. Are you an insurance broker worried about managing the added operational and transactional requirements of New York’s new Paid Family Leave laws? Although the rate has yet to be announced (as of this writing), and no one knows the commission potential, one top DBL

With days left to review the proposed NY Paid Family Leave regulations, what should you know? NY Paid Family Leave, the most comprehensive Paid Family Leave program in the country, is set to go into effect January 1, 2018. But for employers and brokers preparing for the moment, the date isn’t as far off as

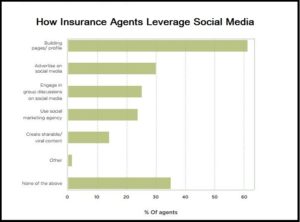

Your insurance agency is sure to get noticed if you use these tactics to reach prospective clients. The world of insurance is changing rapidly, but word-of-mouth referrals remain the biggest source of leads for property and casualty brokers. Word-of-mouth, today, means a lot more than attending local networking meetings or playing golf with business owners

Insurance brokers can receive better service working through the right insurance wholesaler. Being an insurance broker isn’t easy, especially in these challenging times. Will Obamacare stay or will it go? How will that affect health insurance brokers, as well as those who provide ancillary benefits? The industry could be facing another major shake-up–but even that’s

Brokers can profit by providing your customers with the information they need about Paid Family Leave. Last year, New York State announced new Paid Family Leave regulations to be phased in over four years starting in January 2018. The regulations would give New York families the best coverage in any state, surpassing even California, which

Even with Trump’s proposed tax code changes, term life and Group Life / AD&D still a safe bet. Are you a property & casualty, disability, or health insurance broker looking for new revenue streams? Life insurance might just represent another avenue to increase your book of business. According to the Insurance Barometer Study, conducted jointly