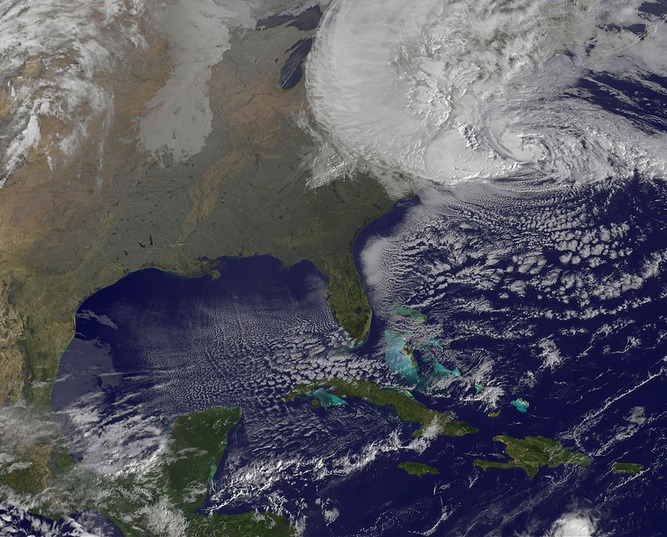

History (nearly) repeats itself with the introduction of Paid Family Leave October 29, 2012: It was a sad day for many New Yorkers as properties were swept away in Superstorm Sandy, businesses went under, and more than 8.1 million homes across the U.S. were left without electricity for a week or more. Superstorm Sandy caused

Bold statement from DBL Center President Michael Cohen leads into how brokers can grow their book of business with PFL P&C and health brokers know that enriched DBL in New York can be a tough sell. As a mandatory benefit, DBL is a no-brainer, but let’s face it: The commissions aren’t making anyone rich. That’s

One of The DBL Center’s preferred carrier partners, AmTrust, offers the information you need to help your clients get ready for PFL and ensure compliance. “At the early stage of any new insurance regulation, education is key.” This is how Joy Maas, Director of Marketing, Sales, and Accountant Management for AmTrust Financial Services, a top

The DBL Center and ShelterPoint Life help clear up confusion about Paid Family Leave in New York Are you ready for Paid Family Leave in New York? No doubt, employees are ready to enjoy more socially conscious, financially viable leave to care for newborn children, aging or sick loved ones, or adopted or foster children.

With days left to review the proposed NY Paid Family Leave regulations, what should you know? NY Paid Family Leave, the most comprehensive Paid Family Leave program in the country, is set to go into effect January 1, 2018. But for employers and brokers preparing for the moment, the date isn’t as far off as

- 1

- 2