As people plan for the holiday season, travel, and shopping the sales, insurance brokers who manage NY Disability Benefits Law policies for clients are also planning for an important event.

Fourth quarter premium payments are due for NY Disability Benefits Law for New York businesses. Annual bills will also be due by January 1, 2024, at the latest. Meanwhile, many businesses are evaluating their budgets for 2024, making it the perfect time to enrich NYS DBL and expand their company benefits packages.

Since most businesses have their premium payments set up on autopay, it’s easy for brokers to use The DBL Center’s proprietary Broker Dashboard: Net Revenue Tracker to spot any payments that didn’t process as they should have.

With administrative tasks handled automatically, it frees up brokers’ time to review their clients’ policies and look for opportunities to expand coverage.

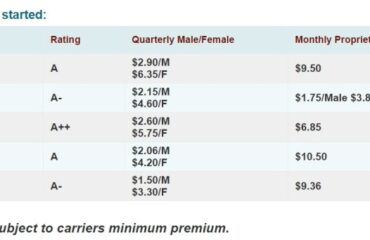

NYS DBL Rates for 2024

The New York State Insurance Fund announced premium rates and benefits for NYS DBL coverage and Paid Family Leave (PFL) for 2024. The NYS DBL Benefit payment for 2024 is up to 50% of their average weekly wages, up to $170 per week for 26 weeks. Employees contribute 0.5% of taxable wages, up to $0.60 per week, while employers cover the balance of the plan. Employers can also opt to pay the full primum amount.

Paid Family Leave benefits in New York pay 67% of wages for up to 12 weeks, with a maximum benefit amount of $1,151.16 per week. PFL is usually written as a rider to DBL coverage, but The DBL Center can also write PFL as a stand-alone benefit.

Why It Pays for Business Owners to Enrich NYS DBL Now

Inflation remains a significant concern for many Americans, and especially in New York, where the cost of living is 30% higher than the national average, based on statistics from RentCafe.

In the beginning of 2023, one-third of Americans called inflation their “number one stressor” going into the new year, according to a survey by personal finance site GOBankingRates.

With this in mind, it’s easy to see that $170 a week barely puts food on the table for most New York families. If a worker becomes ill or injured off the job and needs to take time off, it can be financially devastating if they don’t have other sources of income.

New York recognized the importance of supporting families with a generous Paid Family Leave policy. New York business owners should consider enriching DBL to provide the same safety net for workers whose condition requires short-term disability.

Enriching DBL in NY can help reduce employee financial stress and help ensure that employees return to work when they are able.

A study from Graystone Consulting found that 49% of employees who are distracted about their finances at work may spend 19.5 days, in total, over the year, dealing with personal money matters. Enriched DBL is not the end-all solution to financial stress for employees but having that financial safety net can help make the return to work after an accident or illness less stressful. Enriched DBL is an affordable benefit that pays off in employee satisfaction and reduced financial hardship for employees who might be working paycheck-to-paycheck.

Consider Ancillary Benefits to Fill Coverage Gaps for Clients

Statutory benefits like those required by NY Disability Benefits Law aren’t a “big-ticket” item like healthcare insurance. Brokers may not always consider the advantages and importance of enriched DBL.

But you could be leaving money on the table if you don’t take time in the fourth quarter to evaluate your clients’ benefits packages and look for coverage gaps, starting with enriched DBL but also other benefits.

Ancillary benefits can also reduce stress when an employee is ill or injured outside of work. Voluntary worksite benefits such as accident insurance and critical illness insurance give employees the supplemental coverage they need for hospital bills and co-pays, mortgage or rent and other living expenses, and even treatments that may not be covered by their primary health insurance provider.

Premium costs for ancillary benefits can be covered by the employee on a voluntary basis or with costs shared between the employer and employee. This makes these benefits a powerful recruiting and retention tool for businesses, often at no expense to the employer.

NY Disability Benefits Law: Let The DBL Center Handle It For You

As New York businesses pay their annual or quarterly premiums required by NY Disability Benefits Law, it’s a good time for brokers to reach out and evaluate additional coverage options with clients. Let The DBL Center act as your back-office staff to generate proposals, provide rate quotes, and deliver the service you and your clients deserve through 2024 and beyond.