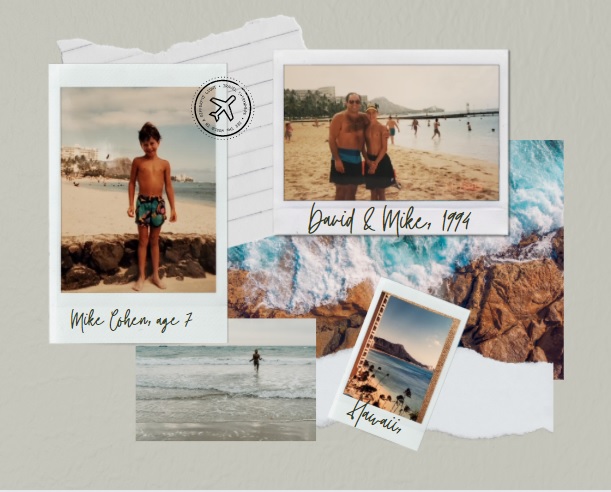

After graduating from Boston University in 2002, Michael Cohen spent several years in the film and television industry, working as a producer, writer and stand-up comedian. Licensed to sell insurance at the age of 18, Cohen entered the family business full time in 2005 and brought the experience of the entertainment industry to The DBL Center.

Nine years later, he became a member of the prestigious Friars Club in NYC, where he found a way to blend his passion for the arts with his day job to assist with the growth of The DBL’s Center’s General Agency, which he is proud to say has more than doubled since he came on board.

Massachusetts becomes the fourth state in the Northeast to mandate benefits under a paid family and medical leave act DBL Center, the family-owned and operated wholesale insurance general agency specializing in statutory short-term disability benefits, is ready to offer Massachusetts insurance brokers and business owners incredible savings on PFML plans under the new Massachusetts Paid

Here’s How to Help Your Customers Switch to a Private New Jersey TDB Plan I’ve discussed on several of my videos recently how fast time moves, and how crucial it is for us all to adapt to selling insurance in the time of Covid-19. Insurance brokers face more challenges than ever before when it comes

Just like New York, New Jersey, Massachusetts, and Connecticut, Hawaii also offers temporary disability insurance to employees for non-work related injury or illness. There is no maternity leave or paid leave component to Hawaii TDI, but the plan provides coverage for a pregnancy-related disability as well as other non-work related illnesses or injuries. As with

Most of us are happy to close the door on 2020, a year with multiple challenges from different fronts. While 2021 may not come in carrying a magic wand that will end the pandemic and the economic struggles of small business owners, it carries hope for a stronger future. Insurance brokers can follow these six

We all know 2020 presented major challenges for insurance brokers. I discussed some of these challenges with Charles Callery, Regional VP for Lincoln Financial, and Michael Pelligrino, Lincoln Financial sales representative in the video, “Getting Creative in the Time of Covid-19.” So much has changed this year – but adapting is an important part of

The recent Massachusetts Family and Medical Leave Act legislation has caused some confusion regarding who is eligible for FMLA, since the definition of “Family” according to the Massachusetts Commonwealth extends beyond what many people think of as immediate family. As Massachusetts insurance brokers grapple with new legislation surrounding the Massachusetts Family and Medical Leave Act

The New York State Disability Benefits Law (DBL) mandates every “covered” employer (employers with one or more employees) to provide private disability insurance in New York to employees who are ill, injured off-job, or pregnant. To stay in compliance with the law, the employer can purchase private disability benefits insurance in New York either from

Even if your business is exempt from the Family and Medical Leave Act (FMLA), you might still have to participate in the Paid Family and Medical Leave (PFML). FMLA provides certain employees with unpaid protected leave for specific family or medical-related reasons. PFML, on the other hand, provides paid protected leave to workers for family

Last year, the State of New Jersey announced a rate hike and benefits increase for NJ State temporary disability insurance to go into effect in 2020. The first increase took place on January 1, 2020, when the NJ state disability insurance benefit increased to 66.67% of a worker’s average weekly salary to a maximum of

NYS PFL rate and benefit increase goes into effect January 1, 2021As per the original legislation for the NYS Paid Family and Medical Leave Act, New York has announced a rate change and benefit increase for NYS PFL to go into effect January 1, 2021. Beginning in 2021, employees can collect up to $971.61 through

The CT Paid Family Medical Leave (PFML) provides “covered” employees in Connecticut access to paid leave for life events covered under: Family and Medical Leave Act (FMLA) Connecticut Family and Medical Leave Act Connecticut Family Violence Leave Act Covered employee means a worker who is currently employed, has been employed within the last 12 weeks, self-employed,