In past years, DBL Center insurance brokers didn’t write private New Jersey TDB (temporary disability benefits) past the first quarter. Business owners had already paid the bulk of the premiums into the New Jersey State Insurance Fund and there wasn’t a lot of cost savings to be realized writing policies mid-year.

In past years, DBL Center insurance brokers didn’t write private New Jersey TDB (temporary disability benefits) past the first quarter. Business owners had already paid the bulk of the premiums into the New Jersey State Insurance Fund and there wasn’t a lot of cost savings to be realized writing policies mid-year.

But with the New Jersey TDB premium rate hike (and benefit increase), more business owners are looking to privatize coverage into the summer. Business owners can switch plans up until July 1, 2021 and realize substantial cost savings along with superior service and flexible payment options.

Are you ready to let your customers in New Jersey know about this important change?

This year’s premium bill for New Jersey TDB coverage is enough to give any business owner sticker shock – especially when so many businesses are just beginning to recover from the pandemic and seeing an increase in profits as consumer spending starts to rise. We’re seeing this in every sector, but especially in travel, entertainment, hospitality, and clothing retail, where shoppers seem to be opening their wallets as fitting rooms open.

Of course, business looking up is good news, but for employers looking to increase staffing in anticipation of profit growth, the TDB premium increase can hit hard when they aren’t quite ready for it.

As in 2020, the taxable wage base is different for employers than for employees in 2021. Employees contribute 0.47% on the first $138,200 of earnings, which maxes out at $649.54. Employers contribute based on employees’ earnings, with a maximum of $36,200 annually for the company.

Insurance brokers can save the day with a private policy that:

- Reduces the premium rate for employer contributions

- Covers the assessment fee up to $10 per employee per year

- Saves business owners up to 20% or more on premiums

Ten dollars per year may not sound like a lot, but if the business has just 100 employees, that adds up to an extra $1,000 in savings per year – plus up to 20% savings on premiums. With the current labor shortage, reducing employee contributions can also put money in workers’ pockets, which can help attract talent in virtually any business.

As David Cohen used to say, “Nickels, dimes, and quarters make dollars.” Show your customers this wisdom, and how it can boost their bottom line, and you will earn their trust, loyalty, and future business referrals.

Help Business Owners Provide Workers with Greater Peace-of-Mind

Quality insurance coverage is still on workers’ minds. As we’ve seen during COVID-19, an unexpected accident or illness can set families back financially for months or even years. Employers can give their best workers peace-of-mind with high-quality short-term disability coverage.

When your customers work with you to privatize TDB coverage, they receive:

- Premium white-glove, white-label service through the DBL Center

- Flexible payments in their choice of debit card, check, or direct deposit

- Opportunities to bundle ancillary benefits for added cost savings.

Statutory insurance brokers who help their customers switch to a private TDB policy in New Jersey through one of our top-rated carriers also gain access to our exclusive Broker Dashboard: Net Revenue Tracker to better manage renewals and cancellations and to track commissions with a click from any internet-enabled device.

How to Help Your Customers Make the Switch to Private TDB

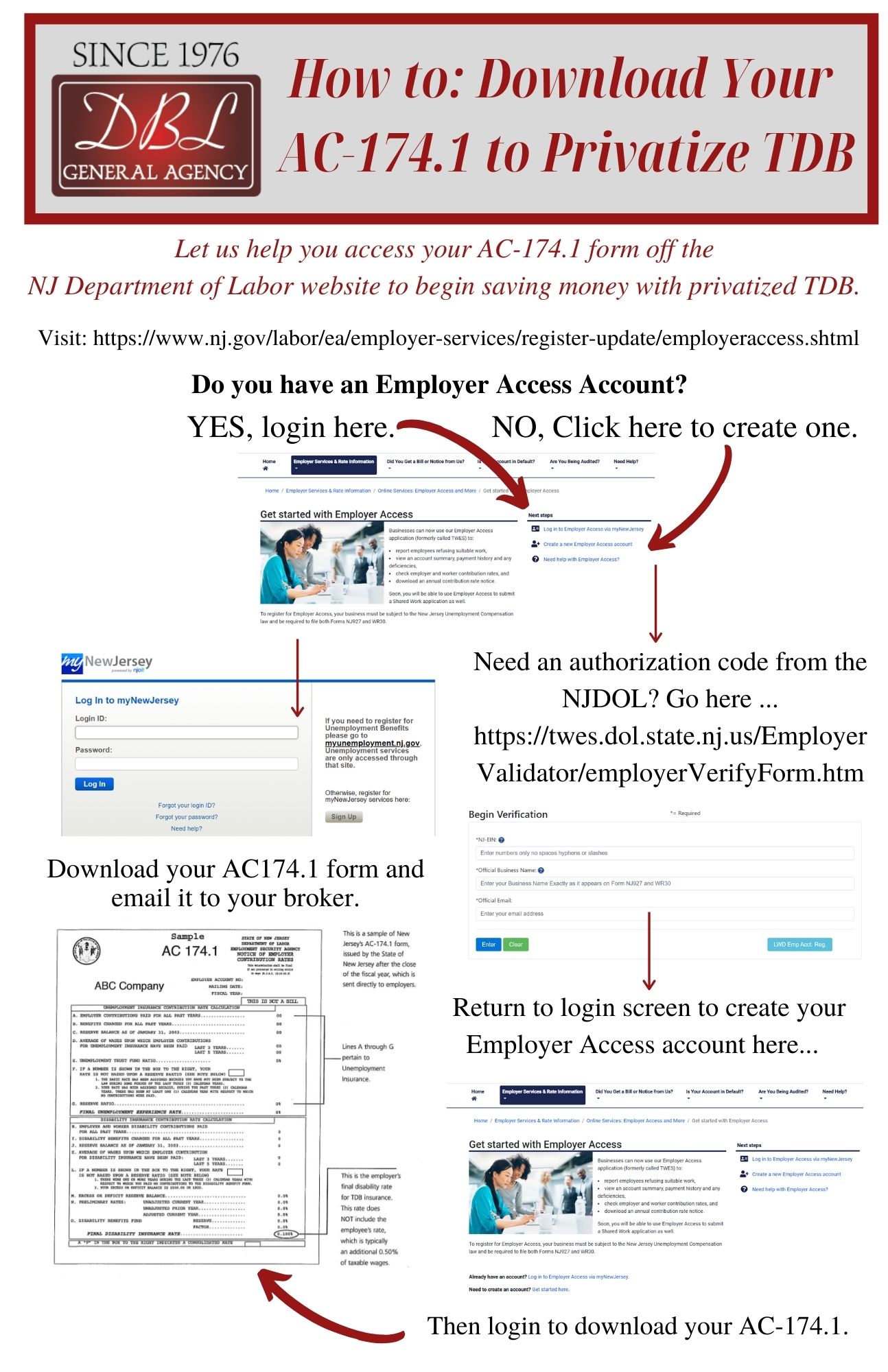

The DBL Center will be there for you and your customers every step of the way as they make the important, money-saving decision to privatize their TDB coverage in New Jersey. However, your clients must take an important first step by downloading their AC174.1 form from the New Jersey Department of Labor and Workforce Development Division of Employer Accounts. They can login with their password or create a new account here: Employer Access account (formerly called TWES).

They will also need to provide you with a census that includes the number of lives in their organization, genders, dates-of-birth and salaries for every qualified employee. With that information, the DBL Center will work directly with you, the broker, to shop their policy around for the lowest rate. We’ll also see if they can garner even more savings – and boost your commission – with ancillary benefits, too.

Since New Jersey waived the signature requirement for employees to opt-in to private coverage, it’s easier than ever to privatize TDB. We’ve even created a handy infographic that shows customers how to obtain their AC174.1 from the New Jersey Department of Labor website. Once they’ve got that information, you can let The DBL Center team do the rest.