Recent insights from nonprofits show people vastly overestimate life insurance costs.

When it comes to selling life insurance and other ancillary benefits, insurance brokers face a vast, untapped market: younger working Americans. What’s the best way to reach this market, especially when Gen Z tends to trust TikTok and other social media for financial advice?

First, it helps to understand the knowledge gaps younger generations have about employee benefits and private insurance. Then, it’s necessary to build trust with this audience, whether that involves webinars and marketing materials or sharing the advantages of group life AD&D through their employers.

Survey Says…

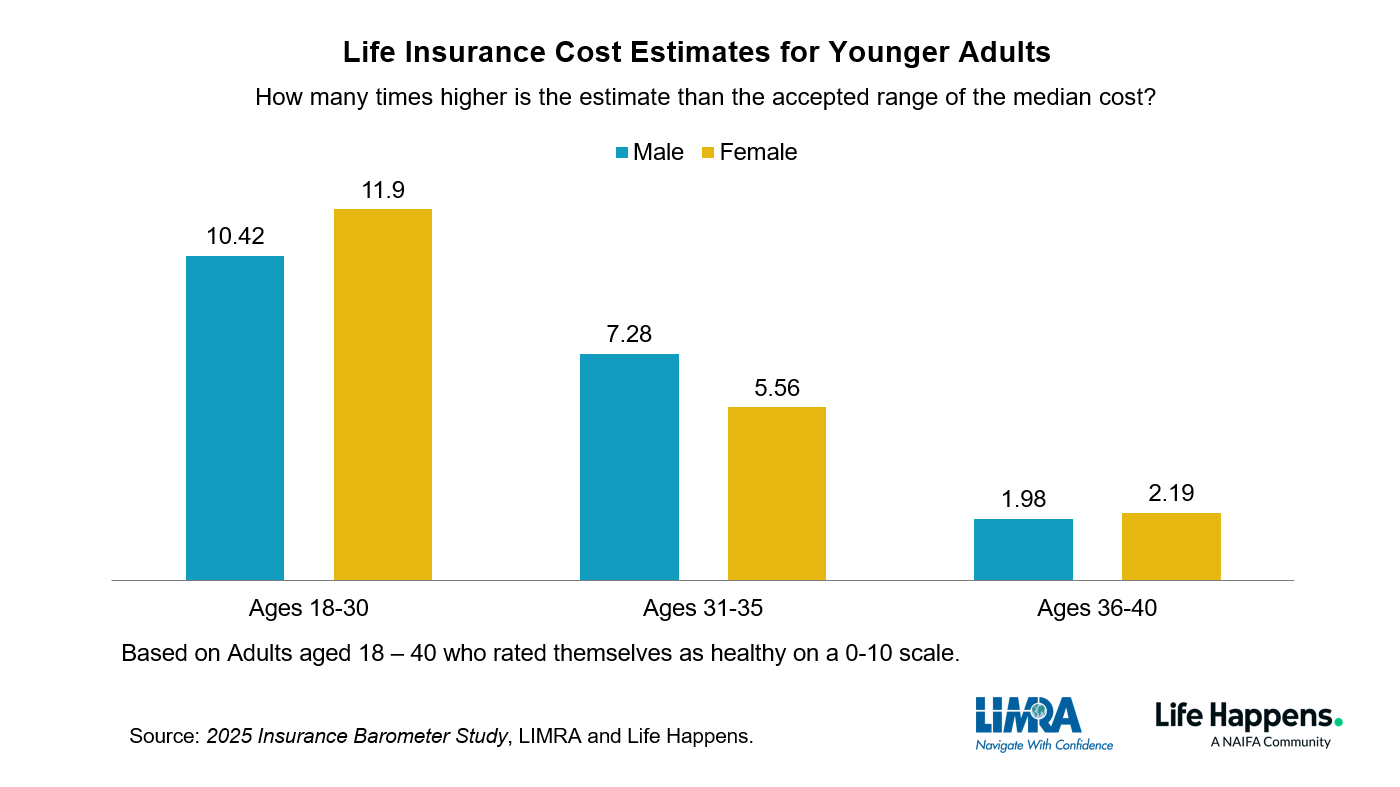

The 2025 Insurance Barometer Study, conducted by LIMRA (the Life Insurance Marketing and Research Association) and Life Happens revealed that young adults aged 18 to 30 overestimated the median cost of life insurance by roughly 10% to 12%. Younger millennials (ages 31 to 35) overestimated the cost by roughly 5.5% to 7%.

The survey also found that more than 75% of Gen Z and millennials (up to age 40) who don’t have a policy said they don’t understand the life insurance underwriting process. That includes how insurance companies assess risk and determine rates and terms. This group also said they didn’t understand the different types of life insurance available.

The Crucial Role of Insurance Brokers

Insurance brokers play an important role in today’s world, where 80% of adults under 25 said they get information regarding financial and insurance products from social media. Of the young adults who use social media as a source of financial tips, one-third said they follow “influencers.” However, 45% follow bona fide financial advisors on social, which indicates they are open to advice from professionals.

And, although nearly 60% said they would use artificial intelligence to research life insurance, 42% said they prefer to buy from a financial professional in person.

Building trust and sharing the true costs and facts about the affordability of life insurance is an important first step for brokers interested in securing these sales.

“In a separate qualitative LIMRA study, even when young adults were presented with a true median cost of an insurance policy, some participants still doubted us,” Bryan Hodgens, senior vice president, head of LIMRA research, said in a LIMRA news release. “This remains one of the biggest challenges for our industry to overcome — convincing consumers that life insurance is far more affordable than they realize.”

Brian Steiner, Executive Director of the educational nonprofit Life Happens, now a NAIFA community, added in the same release, “Companies and financial professionals need to meet consumers where they’re at with education and authenticity so we can show them how life insurance provides a stable way to protect their families.”

The Advantages of Group Life Insurance Plans

Although “perceived cost” stands as the number one reason Gen Z, millennials and GenX, many of whom are approaching retirement years, don’t invest in life insurance, the survey implies that many would consider Group Life / AD&D if their employer offered it.

Overall, 51% of Americans between the ages of 18 and 75 carry life insurance, according to the report. And 55% of working adults have life insurance through their employer. One-fifth of Gen Z, along with 14% of millennials and 9% of Gen X, stated they don’t have life insurance (or don’t have enough coverage) because it’s not offered by their employer. This presents a tremendous opportunity for insurance brokers to offer group life / AD&D options

As more states mandate disability and family leave insurance, it’s important not to forget the ancillary benefits that help create a comprehensive benefits package.

“Disability insurance or paid medical leave helps a worker get through a short-term injury or illness without a tremendous hit to their income, savings, or investments. Paid family leave allows workers to take time off to care for others,” explained Michael Cohen, The DBL Center president and CEO. “Life insurance is also designed to help a worker’s family and provide peace-of-mind to their loved ones. Just because it’s not required by the state doesn’t make it any less important.”

The DBL Center can help insurance brokers save their clients’ money on required benefits and roll that savings into ancillary benefits that help give employees a greater sense of financial security.

Reach out today and let us help you expand your book of business with required and ancillary benefits.

FAQs

How much does a $1,000,000 life insurance policy cost per month?

As with any life insurance policy, monthly premiums for a $1,000,000 life insurance policy vary based on the age and health of the insured. Whole-life policies cost more than term life. Most group life / AD&D insurance plans often have coverage limits less than $1 million, but you may consider executive carve-outs for larger policies.

Is $1 million life insurance worth it?

Carrying a life insurance policy with $1 million in death benefits may sound like a lot of money. But the amount of coverage people need so their family can maintain their current lifestyle if the primary breadwinner dies varies greatly. A $1 million policy can cover funeral costs, pay off a home mortgage, and provide for living expenses. But term-life with a $1 million death benefit may not be the right choice for everyone.

Do you pay taxes on life insurance?

As a general rule, life insurance benefits are not taxable for beneficiaries. However, cash value withdrawals on permanent or whole life insurance policies may be taxed if the withdrawal exceeds the premiums paid. Premiums for group life / AD&D policies paid for by the employer may be taxable on coverage exceeding $50,000. It’s important to consult with a tax professional to understand the tax ramifications of insurance policies.