Just like New York, New Jersey, Massachusetts, and Connecticut, Hawaii also offers temporary disability insurance to employees for non-work related injury or illness. There is no maternity leave or paid leave component to Hawaii TDI, but the plan provides coverage for a pregnancy-related disability as well as other non-work related illnesses or injuries.

As with the other states, Hawaii increased its maximum disability payments and premium rates for 2021. The new rates for temporary disability insurance in Hawaii are as follows:

- 58% of average weekly wages (AWW) rounded up to the next dollar

- Maximum benefit of $640 per week

- Maximum 26 weeks temporary disability coverage paid in any benefit year – the benefit year equals 12 months from the first date of disability

In addition, there is a seven-day waiting period before state benefits for Hawaii temporary disability insurance kicks in. Benefits are payable from the eighth day of disability.

The DBL Center Can Help You Write TDI in Hawaii

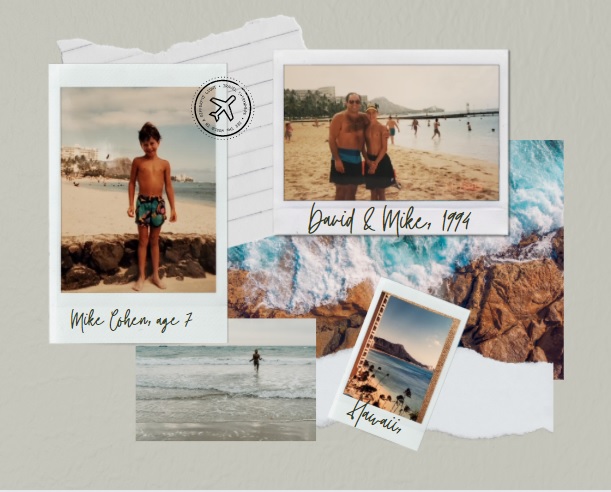

The DBL Center entered the Hawaii temporary disability insurance back in 1986. My father, DBL Center Founder David Cohen, was looking for ways to grow the wholesale general agency. He had heard that California offered the benefit and was eager to have offices on both coasts, so he hopped on a plane to L.A. where he connected with a state insurance representative who mentioned, yes, they indeed offer the benefit, but it is not available as a fully insured option. (These were, of course, the days before Google was at your fingertips).

Dave wound up being directed to The State Insurance commissioner, who directed my father to The Hawaiian Islands, telling him they were also a statutory state, with options to privatize. At the time, Hawaii had no general agency presence, so The DBL Center was on the cutting edge of bringing more options and better service to Hawaii business owners by showing them how to privatize TDI.

Never one to pass up a chance to travel, David Cohen got on yet another plane and, upon landing, began forging connections with insurance brokers across the Hawaiian Islands.

Let’s just say the Hawaiian luau shirt he chose may not have been his best choice for his first meeting. I believe his first broker said he looked like he belonged in The Barnum and Bailey Circus, but ultimately, he showed Hawaiian business owners and insurance brokers that The DBL Center understands the statutory insurance industry like no one else does. Through our massive carrier connections we could – and still can, to this day – provide lower premiums and better service than state plans.

Today, we insure several thousand satisfied customers in Hawaii, and the potential to tap into this market exists for insurance brokers across the country.

Temporary Disability Insurance in Hawaii: Tap into a New Market by Helping Business Owners Privatize Benefits

As the internet makes it easier than ever to connect with business owners across the country, there’s no reason not to tap into the lucrative Hawaii market for temporary disability insurance. As experts in the field of statutory insurance, you can introduce Hawaii business owners to the many advantages of privatizing their TDI coverage, including:

- White glove, personalized service

- Faster claims payouts

- Options to receive benefits in the form of a debit card, check or ACH deposit

Of course, The DBL Center is always here to assist with our state-of-the-art technology, including the Broker Dashboard: Net Revenue Tracker to help you track cancellations, renewals and commissions so you can keep more of what you earn.

Technology has created a world without geographic boundaries. And let’s face it, when travel once again becomes commonplace again – as it surely will within the coming year – there are worse things than having a network of friends and associates in the beautiful Hawaiian Islands.

Increase Commissions by Selling Ancillary Benefits in Hawaii

As you forge relationships with Hawaii business owners, you’ll want to step into the role of consultative selling. Just as in the mainland U.S., you can save business owners money by offering ancillary benefits, including vision, dental, and group life / AD&D coverage.

These benefits increase retention within companies and help business owners recruit talent in highly competitive fields. In the age of Covid-19, employee benefits, including ancillary benefits, become more important than ever as health and wellness moves to the forefront of our minds.

If you’re ready to explore a lucrative new market with temporary disability insurance in Hawaii, reach out today.